Family office

# Family office

The ultimate plan for the inheritance of family wealth.

The term "family office" is not clearly defined in Singapore's Securities and Futures Act.

But according to the definition of the Family Office Association (Family Office Association), a family office is:

"Provide a full range of wealth management and family services for ultra-net-worth families, so that the long-term development of their assets meets family expectations and expectations , And enable its assets to be successfully passed on across generations and to maintain and increase their value."

01

set up Singapore family office, easy access to EP.

The structure of the Singapore family office is that the main applicant sets up two companies in Singapore by himself or his family members. One is a fund company and the other is a family office.

The family office provides fund management services to fund entities (corporate companies incorporated in Singapore), Tax exemption scheme (13R) applicable to Singapore funds /13X).

Through the allocation and management of assets in Singapore, family members can be used as senior managers in the family office to obtain employment pass EP< /strong>(Employment Pass), you can apply for Singapore Permanent Resident Status (PR) if you meet certain conditions.

Spouse and unmarried children under the age of 21 can apply for Dependent Pass DP, parents can apply for >Long-term visit visa LTVP.

02

The specific functions of the family office.

1, family wealth management, Not only determines the direction of wealth investment, but also Corporate Development to make suggestions.

2,Asset protection,< strong>The family office can provide structured protection for the family to avoid loss of family wealth caused by marriage and health risks. At the same time, it pays attention to privacy and provides multi-faceted protection for family assets.

3. in wealth inheritance planning Family offices usually pay more attention to the efficiency of the internal operation of the family.

4. Next generation training and inheritance planning is also the focus of family office work. Continuing education for members of the Duan family to enhance their abilities and qualities, strengthen family human capital.

03

family Common structure of an office.

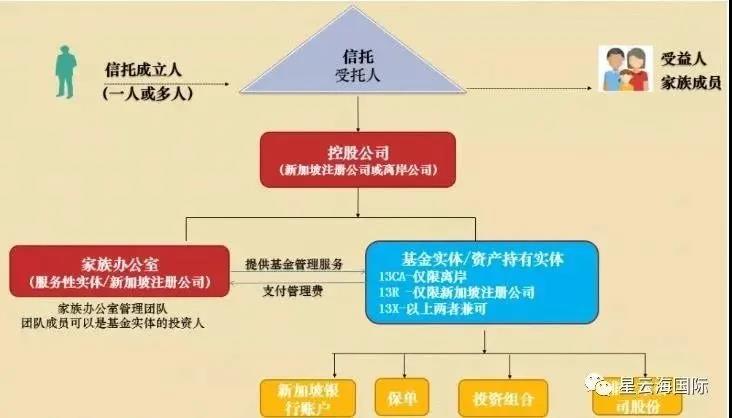

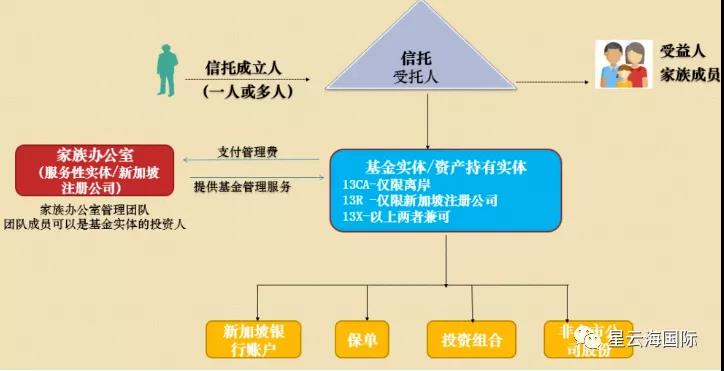

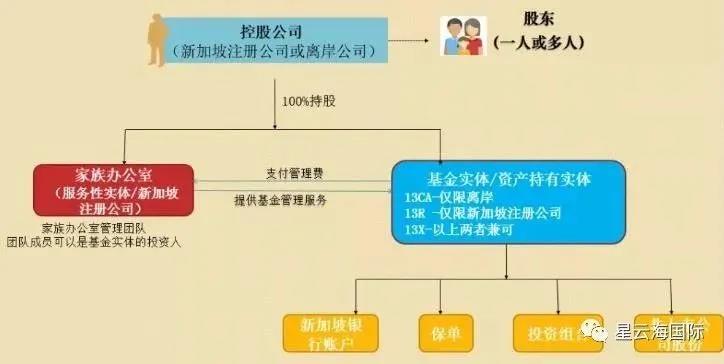

According to the different needs of asset holders, a single family office can be planned with the following three fund structures, family office and trust holding company, Family offices and private trust companies, family offices and holding companies.

Family Office Common Framework One

Common Family Office Framework II

Family Office Common Framework III

It is worth mentioning that the family office can be an ordinary limited company, or it can be placed in the structure of a family trust, so as to Realize long-term inheritance and asset isolation protection functions.

Combining the family trust function can also realize pre-IPO share trust, listed company trust Trusts, charitable trusts, private trusts, etc.

The Kennedy family in American TV dramas

04

What are 13R and 13X?

13R and 13X are tax incentives for funds launched by the Singapore Inland Revenue Department.

Invest at least US$5 million in a fund company established by myself or my family in Singapore, and the investment income of the fund company enjoys tax exemption.

The tax exemption policy can be applied to the company approved by the Monetary Authority, fund managers in Singapore managed by fund managers Generated specific investment income.

There are three preferential tax policies, namely:

13CA (Offshore Fund Tax Exemption Program)

13R (Onshore Fund Tax Exemption Program)

13X (Advanced Fund Tax Exemption Program)

To apply for the above three fund tax incentive plans, the following two conditions must be met:

1. Fund managers need to register with the Monetary Authority of Singapore (MAS) or hold a CMS license. If fund managers manage their own personal assets, they can get license exemption.

Fund managers who apply for license exemption need to submit relevant certificates in accordance with MAS requirements to confirm that the management of their own assets or their own assets is true.

2, The family office must be A local company registered in Singapore.

13R, 13X fund management industry tax exemption policy requirements are as follows (valid until December 31, 2024)

Xingyunhai International?

05

Suitable for the crowd. < /strong>

1, to apply for Singapore PR is the target of high-net-worth family or entrepreneur.

2, hope to establish a family Office, the people who realize sustainable family business and family membership planning.

★ Kind reminder:Due to the actual situation of the case, it may be possible to set up a family office during the actual operation. For many problems encountered, Xiaoxing recommends that you analyze the specific problems in detail.

For more information about the establishment and operation of a family office in Singapore, please contact the Xingyunhai International professional team.

Xingyunhai International

SING YUN

Singapore Family Office

According to the relevant regulations of Singapore: the applicant sets up a family office in Singapore and can incur a fee of S$200,000 per year. The family office can provide Singapore Application for permanent residency status.

By configuring and managing assets in Singapore, let family members serve as senior managers in the family office and obtain an EP Employment Pass (Employment Pass), about two years later Can apply for permanent residence status (PR) for the whole family.

Advantages of immigration to Singapore

★ Chinese liveable: 76% Chinese, the mainstream language is Chinese

★ Tax haven: no global taxation, no inheritance tax, no capital gains tax

★ Bilingual education: high-quality bilingual education environment, using Cambridge education system

★ Good for doing business: Singapore is rated as one of the most suitable countries for doing business in the world

The source of this article: Sino-Singapore French News, MBA Think Tank Encyclopedia, etc., for sharing and discussion only

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece