2021 Knight Frank "Wealth Report"

Key research into global wealth trends

Knight Frank

Knight Frank (Knight Frank International) has just released the 2021 Wealth Report.

This report surveys and studies a large number of ultra-high-net-worth individuals around the world each year, and aims to deepAnalyze the wealth accumulation, financial changes, consumption trends, and investment directions of the top richest people as an insight into global wealth trends Key research.

Knight Frank's "Wealth Report" defines ultra-high net worth individuals-UHNWIs, that is, people with a net worth of 30 million US dollars or more.

Researchers believe that from policy makers to investment participants, lacks insight into the behaviors and attitudes of the top 1% of the pyramid, it’s possible Seriously misread economic trends. And this is exactly what Knight Frank’s Wealth Report can answer.

Let’s take a look at the key findings of Knight Frank’s Wealth Report in 2021 with Xiaoxing:

How did COVID-19 affect this group? Impact?

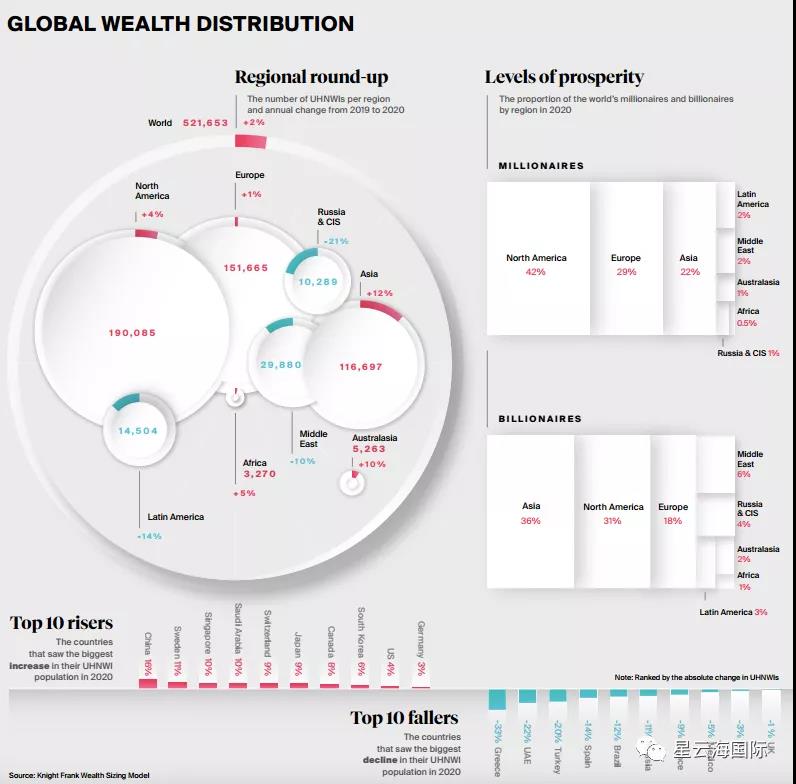

With the reduction of benchmark interest rates, more fiscal stimulus policies, asset price inflation and other trends, the number of high-net-worth individuals in the world has been promoted in the past. It has grown by 2.4% in 12 months to more than 520,000 people.

Although this trend has appeared in both North America and Europe, the real largest increase is in Asia, The increase is 12%.

However, due to currency fluctuations and the impact of the epidemic on the local economy, the number of UHNWIs in Latin America, Russia, and the Middle East has declined .

Asia is a key region for wealth growth   ;

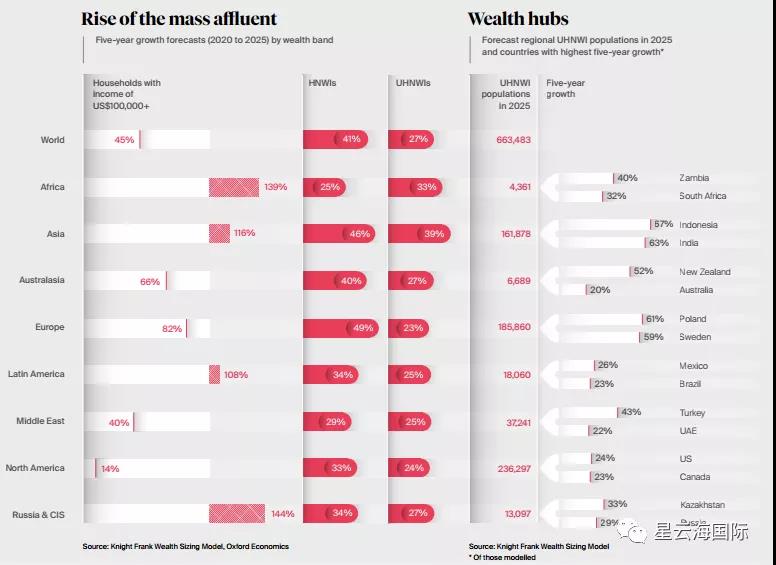

Knight Frank’s "Wealth Report" predicts that the number of UHNWIs in Asia will increase the most in the next five years, at 39%. The global average is 27%.

By 2025, Asian UHNWIs will account for 24% of all UHNWIs, up from 17% 10 years ago.

Asia’s billionaire tax rate has exceeded that of any region in the world (36%). Mainland China is the key to growth. It is estimated that within 10 years of 2025, the super wealthy residents will An increase of 246%.

Globally, the number of ultra-high net worth individuals in the next 5 years is expected to increase by 28% to 663,483, the number of millionaires Will grow by 41%.

Under the trend of globalization, how to configure overseas identity?

In the past year, nearly a quarter of UHNWIs planned to allocate overseas status. The increase is 50%.

According to the "Wealth Report" survey, 11% of Asian ultra-high-net-worth individuals are motivated to allocate overseas assets for education. With London, UK as the main target, the trend of wealthy families permanently relocating to education centers may increase.

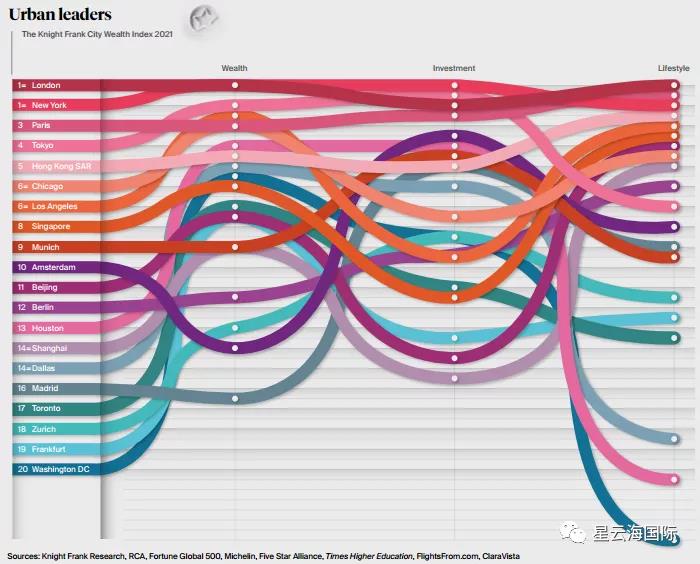

In this year’s "Wealth Report" city wealth index, London, United Kingdom and New York, United States are tied for super high The first choice for net worth individuals.

The survey shows that 26% of ultra-high net worth individuals plan to purchase real estate in 2021.

COVID-19 has stimulated demand in locations such as mountains, lakes, and coastal areas. These demands will drive a 7% increase in prices in major markets this year.

| UK Tier1 Investor

In recent years, the UK has relied on mature and sound laws and regulations, a good investment and business environment, a first-class education system, and an international transportation network that extends in all directions. , A stable and mature financial market, encourage overseas investment and other advantages have continuously attracted many ultra-high net worth individuals.

In terms of educational resources valued by ultra-high-net-worth individuals, British identity has a natural advantage. The main highlights are as follows :

? Tuition: free for public schools under 16 years old, universities are 1/3 or less of that of international students (British passport holders)

? Difficulty of entering a higher education: enjoy the same path and quota as local students

? Accompanying study: Accompanying parents do not need to apply for an accompanying study visa, no need to pay guardian fees, and the accompanying study time is unlimited

? School choice: Younger age: you can go to public or private schools and enjoy the same admission requirements as British citizens; University: have the opportunity to return to China to take the college entrance examination for overseas Chinese students, and there are no restrictions on school choice and majors

? Employment: No visa required, free employment in the UK; no restrictions on returning to the country for employment, while retaining British identity

British Tier1 investment immigration, fast cycle, high success rate, preferred for ultra-high net worth individuals! Welcome to inquire ~ pictures

Xingyunhai International

SING YUN

British Tier1 Investment Immigration

Get the British investment immigration Tier1 visa to enjoy the origin of aristocratic education and pure English environment. Supervision is strictly regulated. London, the UK is the world's financial center. It has the most complete financial regulatory regulations and financial regulatory agencies, and there is no need to cover losses for losses. Get your identity first and then invest to ensure the safety of your funds. Approval is fast, and the procedure for permanent residence is simple.

Simple application:

The main applicant is over 18 years old

no criminal record

2 million pounds invested in UK financial products, such as UK government bonds or UK company stocks, can get permanent residence in the UK for 5 years

Acceleration channel:

Invest 5 million pounds and get permanent residence in the UK in 3 years

Invest 10 million pounds and get permanent residence in the UK in 2 years

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece