On the morning of April 23, a hot search came too fast like a tornado, and the Weibo backstage collapsed again.

Zhao Liying and Feng Shaofeng officially announced a peaceful breakup and said goodbye to their marriage for more than two years.

Netizens said one after another: Too sudden!

On the day when the two officials announced their marriage in 2018, the stock prices of related listed companies had been moved by the wind, such as Baofeng Group rose sharply and once hit the daily limit.

Netizens joked that this marriage is equivalent to "listed company reorganization".

01

The assets of both parties are amazing, and the assets have been divided by the rumor span>

The reason is that the two people are not only popular movie idols (idols), but also entrepreneurs themselves, with many companies and assets under their respective names.

Observing "Forbes", it is not difficult to find that Zhao Liying's income was 190 million yuan a year before marriage, while Feng Shaofeng's income in the same period was 40 million yuan (family assets exceeded 1 billion), The combined income of the two is as high as 230 million yuan. More than 65% of A-share listed companies in the same period.

Feng Shaofeng (Feng Wei) Equity Penetration Chart

According to public information, Feng Shaofeng (Feng Wei) holding five companies (surviving), < span style="color: rgb(192, 0, 0);">Zhao Liying has 7 holding companies (surviving). In addition to investment companies, Zhao Liying also served as a technology company in November 2016 The vice president of the company.

Zhao Liying’s equity penetration chart

According to media reports, the two of them had already found a lawyer not long ago to do a good job of property division. They are currently No business connection.

There is no overlap between the two companies. In addition to the fact that there is no other party’s equity investment in their respective studios, there is even no third-party company that shares shares. At this point, it can be described as a clean conclusion.

Fortunately, the breakup is decent. If the two of you have made preparations for the isolation of related assets earlier, can you divide the assets? To minimize the risk of wealth?

02

Dai Fei and Murdoch use it to avoid wealth risks

According to a lawyer quoted by the financial industry, For high-net-worth individuals, they also need to gently wear "armor" on the weak underbelly of love.

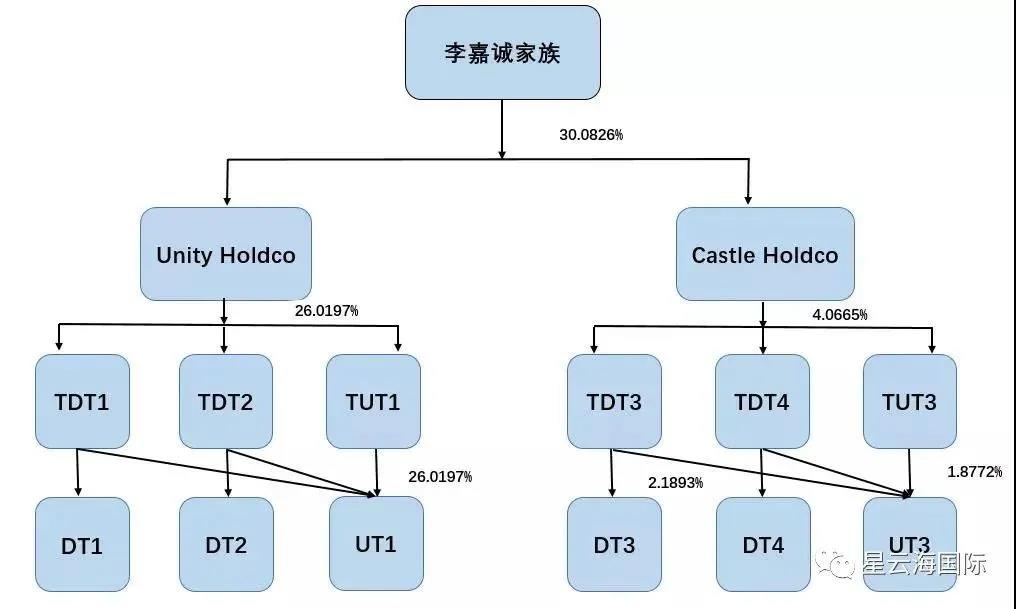

Li Ka-shing’s family trust system

For a long time, many wealthy individuals have used family trusts to implement wealth planning plans, including wealth inheritance, Marriage risk isolation.

Case 1: Princess Diana’s testamentary trust

In 1993, the 32-year-old Princess Diana made a will, requesting that after her death, set up her estate as a trust fund to be managed by a trust organization After the age of 25, the sons will enjoy the trust income as beneficiaries on average. She tragically died in a car accident in Paris in 1997, leaving behind an estate of 21 million pounds and a life insurance policy of 50 million pounds.

After the death of Princess Dixiang, the inheritance delivered to the trust institution has been professionally operated, which has realized a substantial increase in assets and guarantees that the beneficiaries will have rich returns every year. The treacherous changes in the international economic situation have not caused much negative impact on her estate. This is the first to bear the brunt of thanks to her foresight and family trust. Charm, so that maternal love not only shades the two sons, but also benefits the daughter-in-law and descendants.

Case 2: Murdoch’s family trust

World media tycoon Murdoch divorced his second wife Anna at a cost of 1.7 billion US dollars, and almost took all his assets Loaded with 3 family trusts. In the process of divorce with Wendi Deng, Wendi Deng only obtained two properties in Beijing and New York. The family trust played a significant role in the separation of marital risks. effect.

In addition, since Murdoch and Wendi Deng’s two daughters wanted to be the beneficiaries of the family trust, but they were unable to participate in the decision-making of the company’s business under pressure, so the two daughters became the main trust through the family trust (Murdo The beneficiary of the K Family Trust) but has no right to participate in the company’s decision-making

The positive significance of family trust for wealth inheritance:

? Depth Property segregation

? Consolidate family interests

? Prevent diversification of equity

? Improve equity governance

? Reasonable tax planning

Xingyunhai International has rich practical experience in overseas asset and identity allocation and family wealth inheritance. We provide customers with "personal customization, exclusive services". If you have any related questions, please come to consult and discuss!

source | The views in this article only represent the opinions of the author, some of the pictures are from the Internet, and the copyright is owned by the original author

editor | KiKi

Xingyunhai International

SING YUN

Singapore Family Office

According to the relevant regulations of Singapore: the applicant sets up a family office in Singapore and can incur a fee of S$200,000 per year. The family office can provide Singapore Application for permanent residency status.

By configuring and managing assets in Singapore, let family members serve as senior managers in the family office and obtain an EP Employment Pass (Employment Pass), about two years later Can apply for permanent residence status (PR) for the whole family.

Advantages of immigration to Singapore

★ Chinese liveable: 76% Chinese, the mainstream language is Chinese

★ Tax haven: no global taxation, no inheritance tax, no capital gains tax

★ Bilingual education: high-quality bilingual education environment, using Cambridge education system

★ Good for doing business: Singapore Rated as one of the most suitable countries for business in the world

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece