The strength of a country’s passport is most directly reflected in how much it is "freedom".

Today, Singapore passport is visa-free to 192 destinations around the world, and it is like a global passport king.

It can be said that with a Singapore passport in hand, you can come and go for a trip~

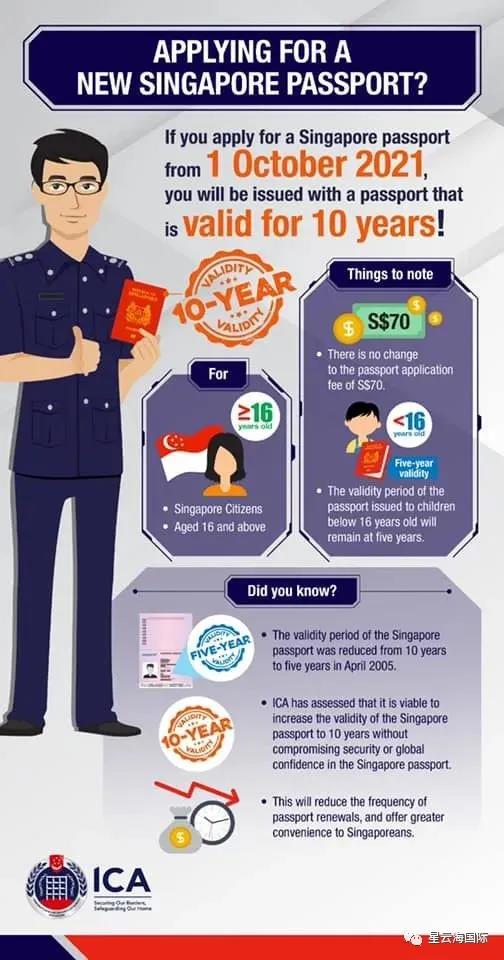

In the past, Singapore passports were renewed every 5 years, and many citizens said that the limited period was too short...

But the latest good news is:

From October 1st this year, Singapore citizens aged 16 and above will have their passports increased from 5 years to 10 years!

And the application fee for passport renewal remains unchanged at S$70.

A "Singapore Passport"

How powerful is the strength

Strength of Singapore Passport

In addition to visa-free destinations, there are many differences between citizens holding Singapore passports and permanent residents (PR) in education, housing, medical care, subsidies, and other benefits. Compared with foreigners, they are "not the same." .

Among the gaps, let Xiaoxing take inventory for you~

Singapore citizens

Educational benefits

Tuition · Free

The primary school tuition fees for children who are local citizens or permanent residents or foreign students vary greatly. Local citizens are free of tuition, permanent residents are 205 per month, and foreign students’ tuition is 775 per month.

Note: ASEAN refers to the Association of Southeast Asian Nations (ASEAN), referred to as ASEAN. There are 10 member states: Indonesia, Malaysia, Philippines, Thailand, Brunei, Cambodia, Laos, Myanmar, Vietnam.

Singapore citizens

Housing benefits

Housing · Exclusive access

The Singapore government stipulates that only Singaporean citizens and permanent residents are eligible to purchase HDB flats. This is an exclusive benefit provided by the government to citizens and permanent residents.

The difference is that only Singapore citizens can apply for new HDB flats, and permanent residents can only buy or lease second-hand HDB flats.

Foreigners can only buy apartments or private houses with land in Singapore.

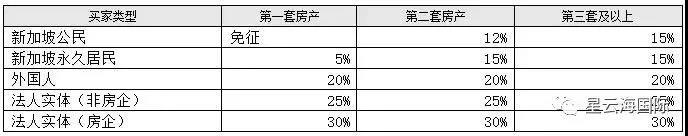

Tax and fee exempt/ultra-low

For foreigners, an additional buyer's stamp duty of 20% is required to purchase the first property.

For permanent residents of Singapore, an additional buyer's stamp duty of 5% is required to purchase the first property.

Singapore citizens do not need to pay additional buyer's stamp duty when purchasing a first property, and the additional buyer's stamp duty payable when purchasing a second property is also lower than that of permanent residents and foreigners.

Data source: Inland Revenue Authority of Singapore (IRAS)

Singapore citizens

Medical benefits

Outpatient fee · Very low

Singapore citizens enjoy a fee that is about 2 times lower than that of permanent residents.

Children's vaccines · discounts

Children with Singapore citizenship can enjoy more government subsidies, even free of charge, when vaccinated.

Specialist clinic allowance · very high

Singapore citizens enjoy a 50% government subsidy for medical treatment in specialist clinics, and a 30% subsidy for permanent residents.

Hospital Allowance · Very High

Singapore citizens living in Class C wards (rooms for 6 to 9 persons) enjoy a government subsidy of up to 80%; Singapore citizens living in Class B2 wards (wards for 5 to 6 persons) receive a subsidy of 65%.

Surgery allowance · Special permissions

Singapore citizens enjoy 65% of the government's surgical allowance.

Singapore citizens

Subsidy benefits

Municipal Council Miscellaneous Fees · Exclusive Permissions

The Singapore government allocates a certain amount of funds in the fiscal budget every year to subsidize the miscellaneous expenses of the municipal council of Singapore citizen families. Only Singapore citizen families can enjoy this subsidy.

Utilities subsidies · Exclusive permissions

Singapore citizens living in HDB flats can also enjoy government subsidies for utility bills. The larger the house, the smaller the subsidy. Permanent residents do not have this subsidy.

Financial aid · Exclusive access

Many financial assistance programs in Singapore are usually only for Singapore citizens. For the kindergarten financial assistance scheme, the applicant's family members must be Singaporeans.

Scholarship Gold or bursary · Exclusive access

Some scholarships issued by government agencies or private organizations are only for Singapore citizens to apply, especially for bursaries. Singapore's highest-level scholarship: Presidential scholarships are only awarded to Singapore citizens.

Annual Library Fee · Free

Singapore citizens do not have to pay any fees when applying for membership of the National Library. Singapore permanent residents need to pay a one-time payment.

Maternity leave · Special permissions

If the child is a Singapore citizen, the mother will enjoy 16 weeks of maternity leave. If the child is not a Singapore citizen, the mother’s maternity leave is 12 weeks.

The maid’s tax · very low

In Singapore, employers are required to pay a monthly maid tax of S$265 for the maids they hire. However, if the employer or spouse has a child or grandson, and the child or grandson is a Singapore citizen under the age of 12, the monthly maid tax that needs to be paid is only S$60.

The benefits of having a Singapore passport go far beyond the above. Do you want to own such a powerful Singapore passport?

Please consult the professional Xingyunhai International for the customization of Singapore's identity planning program!

Xingyunhai International

SING YUN

Singapore Family Office

According to the relevant regulations of Singapore: the applicant sets up a family office in Singapore and can incur a fee of S$200,000 per year. The family office can provide Singapore Application for permanent residency status.

By configuring and managing assets in Singapore, let family members serve as senior managers in the family office and obtain an EP Employment Pass (Employment Pass), about two years later Can apply for permanent residence status (PR) for the whole family.

Advantages of immigration to Singapore

★ Chinese liveable: 76% Chinese, the mainstream language is Chinese

★ Tax haven: no global taxation, no inheritance tax, no capital gains tax

★ Bilingual education: high-quality bilingual education environment, using Cambridge education system

★ Good for doing business: Singapore is rated as one of the most suitable countries for doing business in the world

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece