On May 2, 2021, The Times published a report on Chinese investors investing in the UKThe heavy investigation report.

According to the survey, Chinese investors the total investment in the UK is as high as 134 billion pounds.

Real estate, energy, transportation, medical care, education...

Chinese investors’ investment assets in the UK cover almost all core areas.

Even during the raging COVID-19 in 2020, this situation has not changed.

Allocate core assets in core cities, and the “rich and rich” at the top of China know this well.

After the investment, there are currently controllers or some shareholders of at least 200 British companies are Chinese investors .

Specifically, Chinese state-owned enterprises invested 44 billion pounds in the UK, and the rest was invested by private enterprises.

As some investment data is difficult to track, this indicates that the actual investment may far exceed 134 billion pounds.

What assets did Chinese investors invest in and purchase in the UK? Let’s take a look~

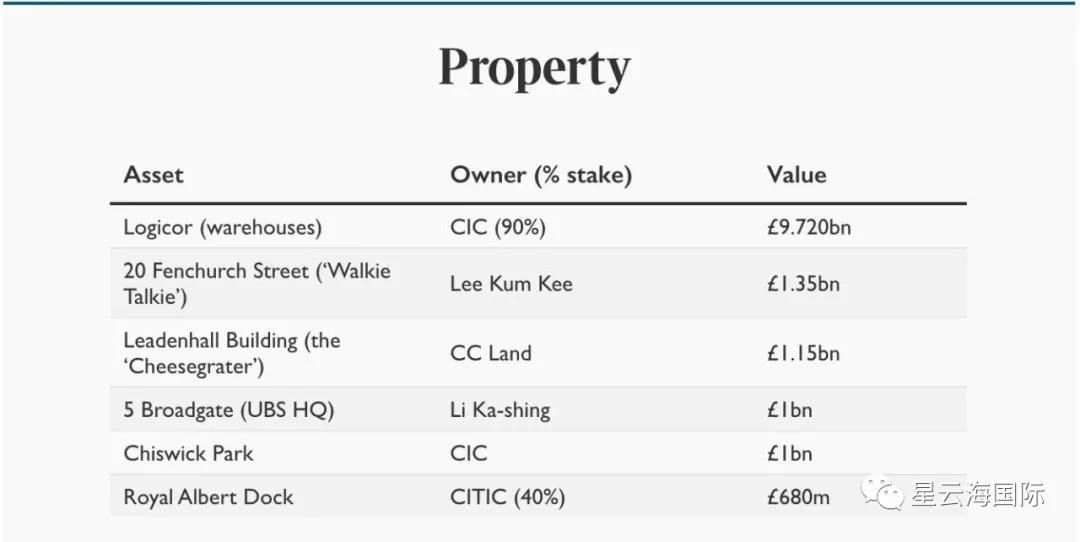

Real estate

According to British media reports, CC Land acquired the iconic "Cheese Gripper" building in the City of London for £1.15 billion. At the same time, Mr. bossZ also bought a super luxury mansion in the UK.

In the first half of 2020 alone, the "Cheese Shaping" building brought 16.7 million pounds (approximately RMB 150 million) to Zhongyu Land Rental income.

Cheesegrater Building

Other familiar buyers include the Li Ka-shing family (acquired the UBS building in London), Lee Kum Kee (acquired the walkie-talkie building), China Investment (acquired logistics assets Logicor and Chiswick Park, the office park in West London), and CITIC took a stake in the Royal Albert Dock ABP.

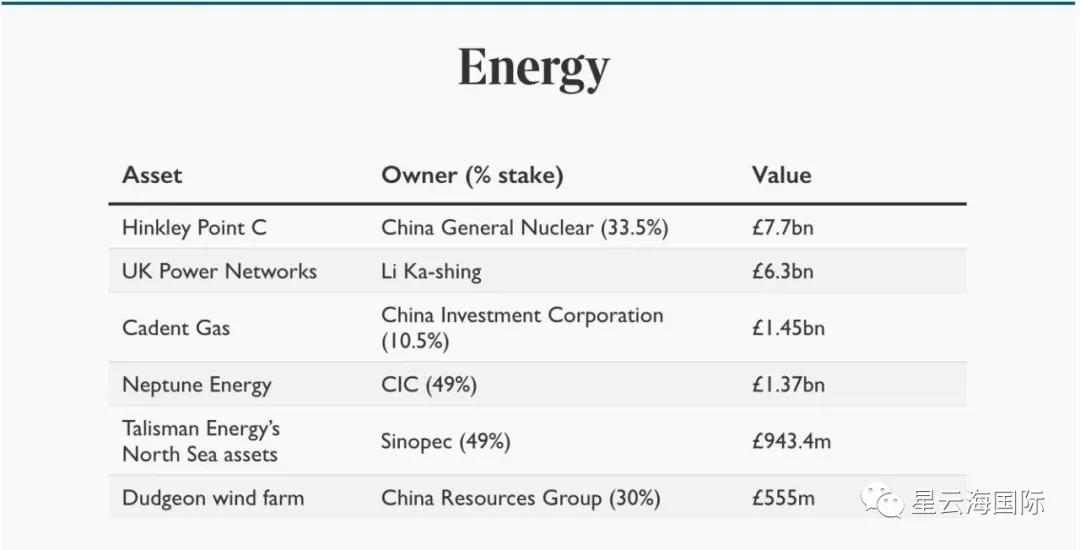

Energy

In terms of energy, China's biggest interest is in nuclear energy, and it also holds a large number of shares in British Petroleum and Natural Gas.

For example, the Li Ka-shing family acquired UK Power Networks.

Major buyers include China General Nuclear Power Group (CGN), China Investment Corporation (CIC), Sinopec, and China Resources Power.

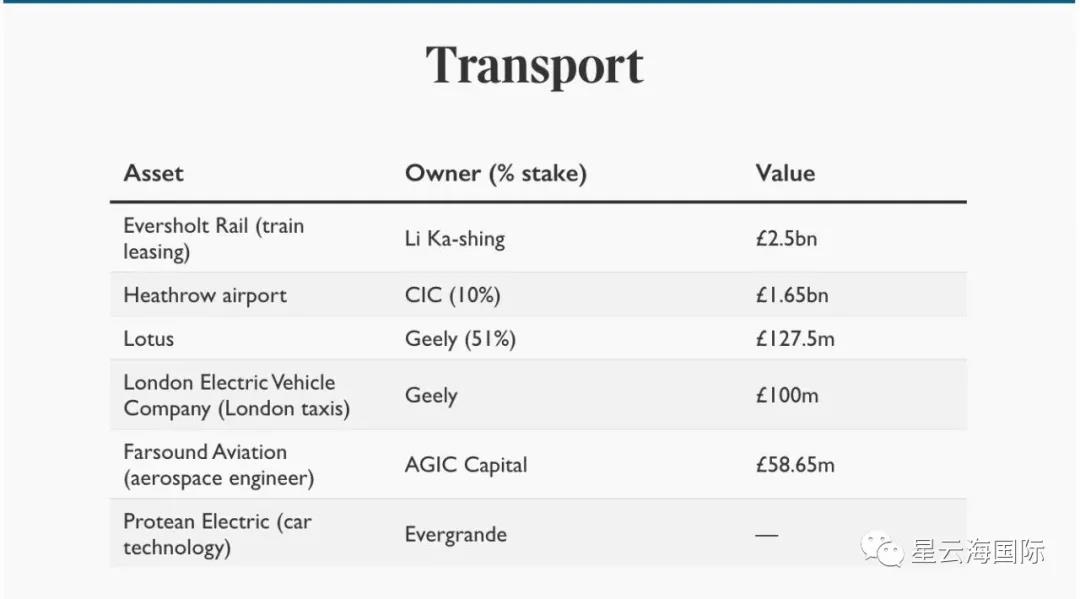

Traffic

Chinese investors hold a large number of shares in key infrastructure companies in the UK.

For example, China Investment Corporation holds 10% of London Heathrow Airport and Thames Water.

Heathrow AirportLondon Heathrow Airport

The Li Ka-shing family holds a large number of shares in the British railway company Eversholt Rail,Geely acquired the British Lotus (Lotus) sports car.

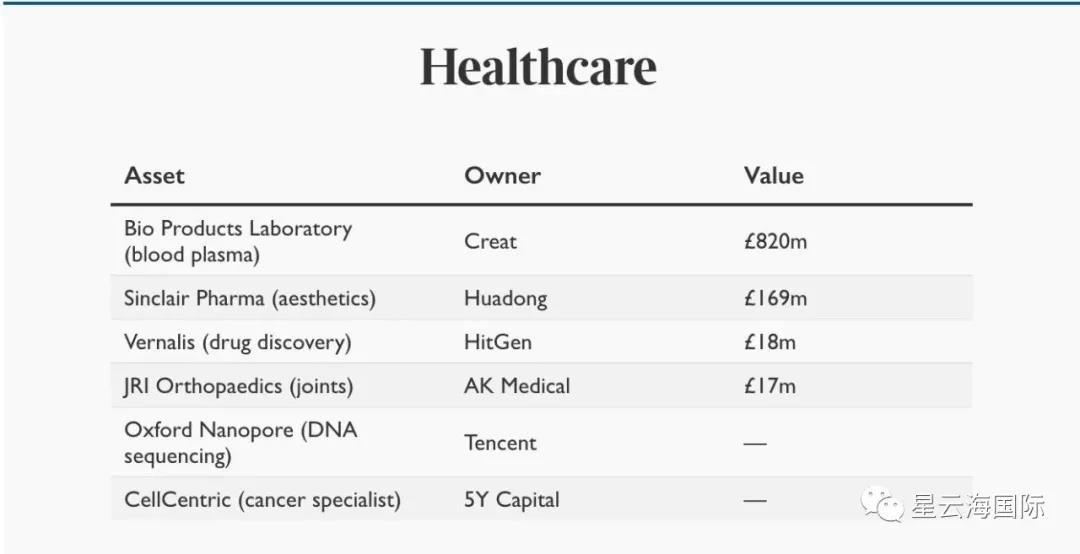

Medical

During the COVID-19 period, many Chinese investors have developed a keen interest in investing in the UK's health sector.

Tencent has acquired shares in Oxford Nanopore, a British gene sequencing company, Rapid detection technology.

CCB International invested in a biotechnology company focused on the development of biologic drugs using soluble T cell receptor technologyImmunocore.

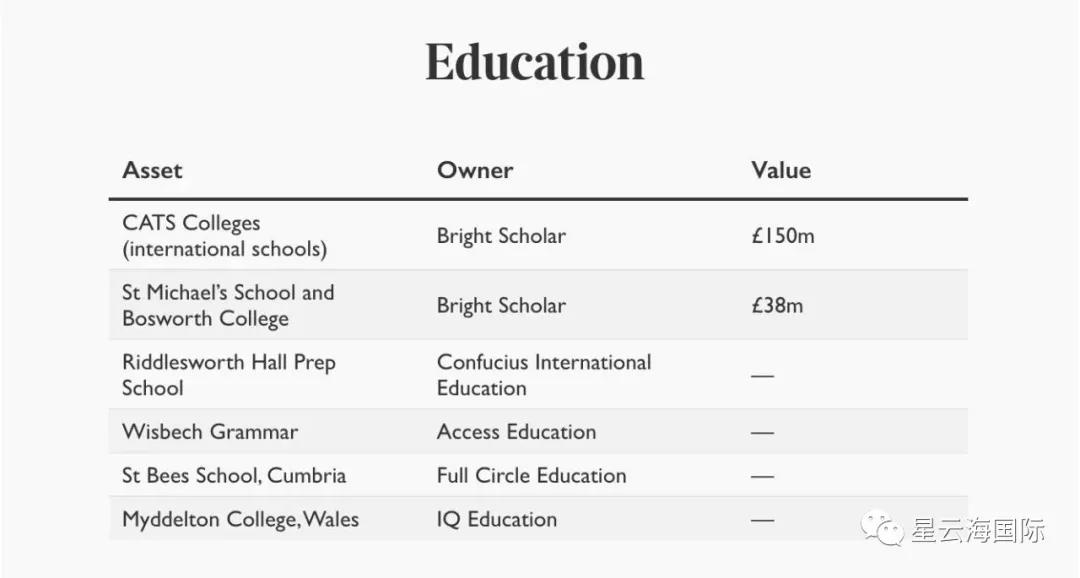

Education

The education sector in the UK has always been one of the favorite industries of Chinese investors. Many British private schools have been acquired by Chinese private investors.

Among them, CATS Colleges, Cambridge College of Arts and Sciences, was purchased by Bright Scholar Education Group, a subsidiary of a leading real estate company, for £150 million in 2019.

CATS Colleges Holdings Limited (Cambridge College of Arts and Sciences)

In addition, Chinese investors also hold 49% of HSBC’s shares, and they are also investing frequently in the retail, entertainment, sports and technology industries.

Financial Times: Ant Financial from China wants to pay 700 million US dollars to acquire WorldFirst

For example, Ctrip bought Skyscanner, a British booking website, Ant Financial bought a cross-border payment company WorldFirst, and Beijing Wentou Holdings bought a British animation and visual effects company Framestore...

Harrods Department Store has supported Alipay payment in December 2018

In the era of globalization, the concepts of overseas layout, risk diversification and value investment have prompted investors to seek better investment targets in many overseas countries.

Among them, Chinese investors are particularly fond of the United Kingdom. Apart from large investments, they are also very keen on identity planning. According to the 2020 immigration data of the British Immigration Service, China is the country with the largest number of applicants, whether it is investment immigration or innovation immigration.

Xingyunhai International has rich practical experience in overseas asset allocation and identity planning. We provide customers with "personal customization, exclusive services". If you have any related questions, please come to consult and discuss!

Xingyunhai International

SING YUN

British Tier1 Investment Immigration

Get the Tier1 visa of British investment immigration, enjoy the origin of aristocratic education and pure English environment. Supervision is strictly regulated. London, the UK is the world's financial center. It has the most complete financial regulatory regulations and financial regulatory agencies, and there is no need to cover losses. Get your identity first and then invest to ensure the safety of funds. Approval is fast and the procedures for transferring to permanent residence are simple.

Simple application

The main applicant has no criminal record over 18 years old,2 million Sterling investment in UK financial products, such as UK government bonds or UK company stocks, can get permanent residence in the UK for 5 years

Acceleration Channel

★ Invest 5 million pounds and get permanent residence in the UK in 3 years

★ Invest 10 million pounds and get permanent residence in the UK in 2 years

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece