On the afternoon of May 13, the 2021 New Fortune 500 list was released.

The top ten rich people have shuffled. Mr. Ma Yun, who has been the richest man in China for three consecutive years, has lost his wealth for the first time.

According to the survey, Mr. Ma Yun's wealth has shrunk by 71.73 billion yuan, ranking seventh with a wealth of 230.41 billion yuan.

Set aside the turmoil. In wealth management, Mr. Jack Ma has been at the forefront, using his family wealth holding structure design to carry out reasonable tax planning.

Xiaoxing takes you from the design of Ma Yun's family wealth arrangement, analyzes the wisdom of high-net-worth individuals' tax planning, and explores the path of reasonable tax planning!

01

How does the Jack Ma family arrange family wealth?

From the prospectus submitted by Alibaba Group Holdings Limited (hereinafter referred to as Alibaba Cayman) to the Hong Kong listing on November 13, 2019, you can get a glimpse of the wealth arrangement of the Jack Ma family.

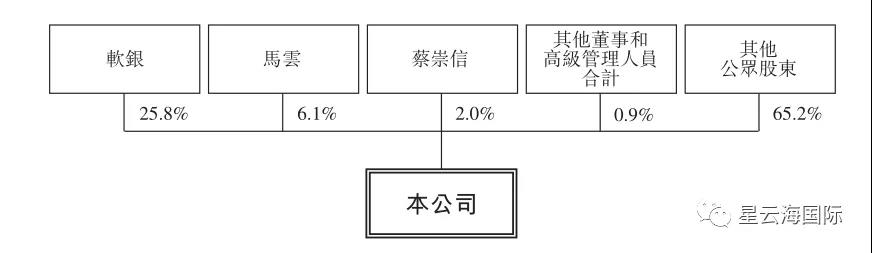

According to the document (shown in the figure below), as of the Latest Practicable Date, the Jack Ma family directly or indirectly holds 6.1% of Alibaba Cayman’s shares, totaling 1,277,691,248 shares.

And this 6.1% of the shares are held by Mr. Ma Yun in four ways.

1,

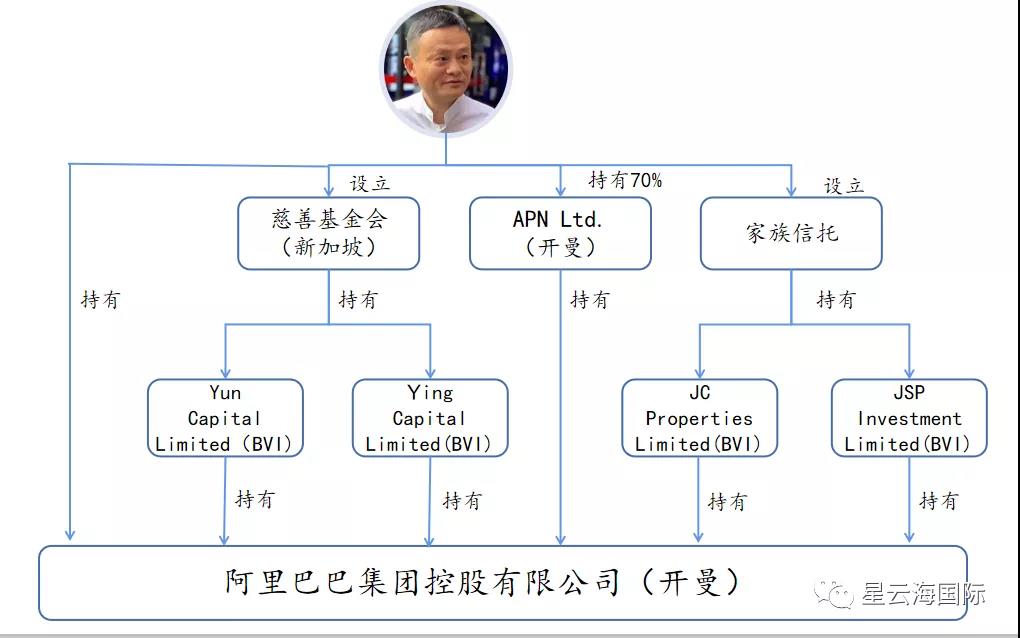

Mr. Ma Yun directly holds 3,160,000 shares of Alibaba Cayman.

2,

Mr. Ma Yunholds Alibaba through APN Ltd. (Cayman Islands company) which holds 70% of the shares 280,000,000 shares in Cayman.

3.

Mr. Ma Yunholds the Jack Ma Charity Foundation. The foundation wholly owns Yun Capital Limited and Ying Capital Limited (both are British Virgin Islands companies).

Among them, Yun Capital Limited and Ying Capital Limited hold 88,591,368 and 88,591,368 shares of Alibaba Cayman respectively. These two companies have granted a revocable voting power to Mr. Ma Yun on these shares.

4,

Mr. Ma Yunwholly owned by a trust in which he and his family are the beneficiariesJC Properties Limited and JSP Investment Limited (both are British Virgin Islands companies).

Among them, JC Properties Limited and JSP Investment Limited hold 418,943,904 and 398,404,608 shares of Alibaba Cayman respectively.

02

How does Mr. Ma Yun use offshore family trusts for tax planning?

From the above we have noticed that Mr. Jack Ma holds shares through offshore family trusts. So, what tax planning advantages does offshore family trusts have?

Offshore family trusts are generally established in areas with higher tax incentives, such as the British Virgin Islands, Cayman Islands, Bermuda, Cook Islands, Jersey, etc.

For trust beneficiaries, offshore family trusts can agree on certain distribution conditions. When these conditions are met, they will be redistributed to the beneficiaries. Large amounts of wealth will be distributed in planned installments. In regions where trust distribution income is taxed, certain The function of deferred tax payment.

Of course, Mr. Jack Ma established a family trustmaybe not purely for tax planning, but for wealth inheritance, equity concentration, etc.< /strong>, but offshore family trusts do have tax advantages.

Mr. Ma Yun’s wealth arrangement wisdom can give us some enlightenment in wealth management and inheritance:

1,

Tax planning must be legal as early as possible.

Mr. Jack Ma’s wealth arrangement was made before the U.S. listing in 2014, and was based on legal compliance.

2,

Comprehensive use of offshore tax incentives, family trusts, etc. for tax planning.

Tax planning is a systematic and complex project, and the comprehensive application of multiple tools and policies can achieve the planning goals.

The offshore family trust + overseas identity configuration is the wise choice for more high-net-worth individuals!

For example, Mr. Haidilao Z, the richest man in Singapore, has configured Singapore identity with his wife, Mr. Logan Real Estate has configured his daughter with St. Kitts identity, and Mr. Zhou Heiya Z has configured his wife with Vanuatu identity...

Xingyunhai International has rich practical experience in overseas identity and asset allocation and family wealth inheritance. We provide customers with "private customization, exclusive services". If you have any related questions, please come to consult and discuss!

source | Comprehensive network, some pictures are from the network, the copyright is owned by the original author, if there is any infringement, please contact to delete

editor | KiKi

Xingyunhai International

SING YUN

Saint Kitts Nevis citizenship by investment program

The Federation of Saint Kitts and Nevis established the citizenship by investment program in 1984 and was the first country in the world to develop such a program. The plan aims to attract high-quality investors to bring large amounts of investment to the country and develop the country's economy. After meeting the investment requirements, investors can apply for the federal citizenship and passport of Saint Kitts and Nevis.

Immigration Advantage

★ One-person investment, family immigration

★ Fast and convenient application, 3-6 months to get identity and passport

★ Freehold property, available for sale after 5 years

★ There is no requirement on the amount of assets, and no proof of source of assets is required

★ No residence requirement, immigration supervision,Overseas taxation, tax haven

★ Passport visa-free or visa-on-arrival 160 countries and regions, travel the world

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece