In recent years, capital markets have appreciated rapidly, real estate in first- and second-tier cities have continued to pick up, domestic and overseas IPOs have accelerated strong> New high-net-worth individuals continue to emerge.

The "2021 Hurun Global Rich List" shows that Zhang Yiming, 38-year-old former ByteDance CEO, entered the top 5 in China for the first time with a fortune of 350 billion yuan | Source: Baidu Encyclopedia< /span>

The newly released "2021 China Private Wealth Report" report predicts that by the end of 2021, the number of high-net-worth individuals in China is expected to be close to 3 million, and the total investable assets will exceed 90 trillion yuan.

As the vane of China’s private wealth management, in this year’s report, what are China’s private wealth new changes, new features and new trends span>? Xiaoxing takes you to sort out

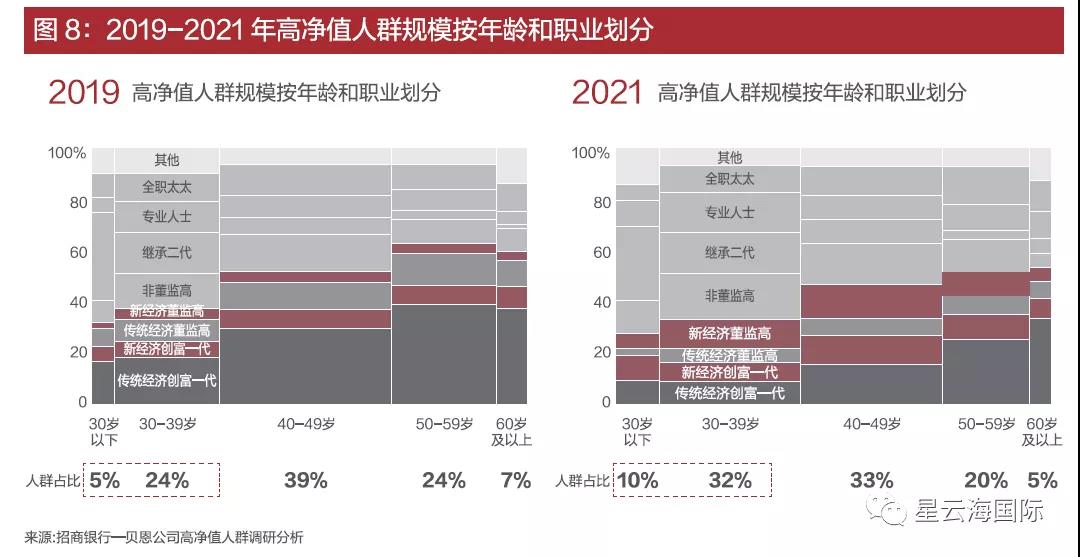

The trend of younger high-net-worth individuals appears

The structure and the scale of wealth creation are more diverse

Driven by the rapid development of the new economy and new industries, the rate of wealth creation of young people has accelerated, under 40 strong>The proportion of new wealthy groups represented by the new economic directors and supervisors and the new economic wealth creation generation among high-net-worth individuals has increased significantly, from 29% in 2019 to 42% in 2021, becoming The backbone of the high-net-worth community.

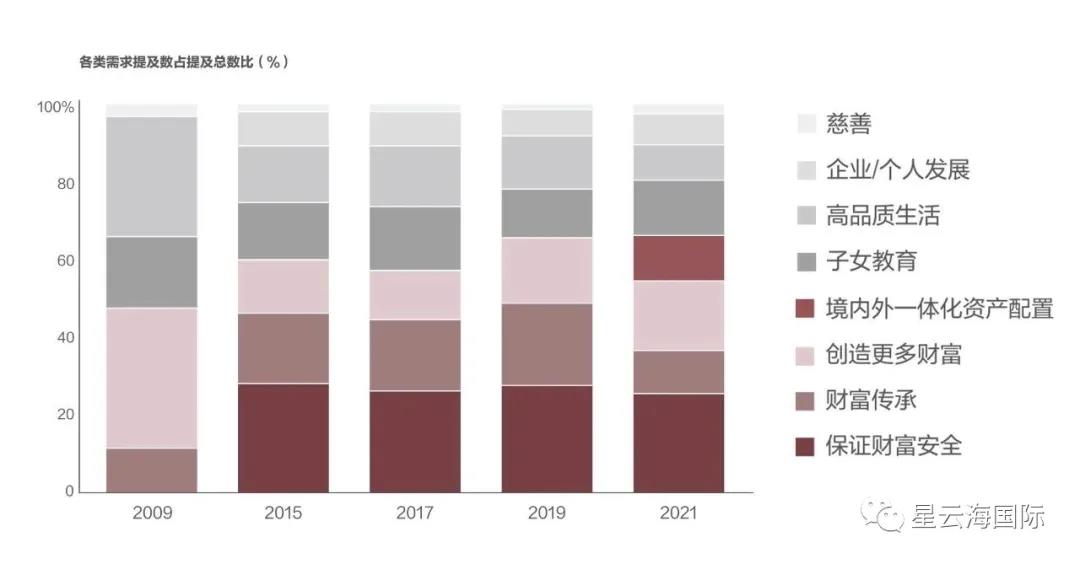

Wealth goals emphasize inheritance from the past

Transform to both wealth creation and inheritance

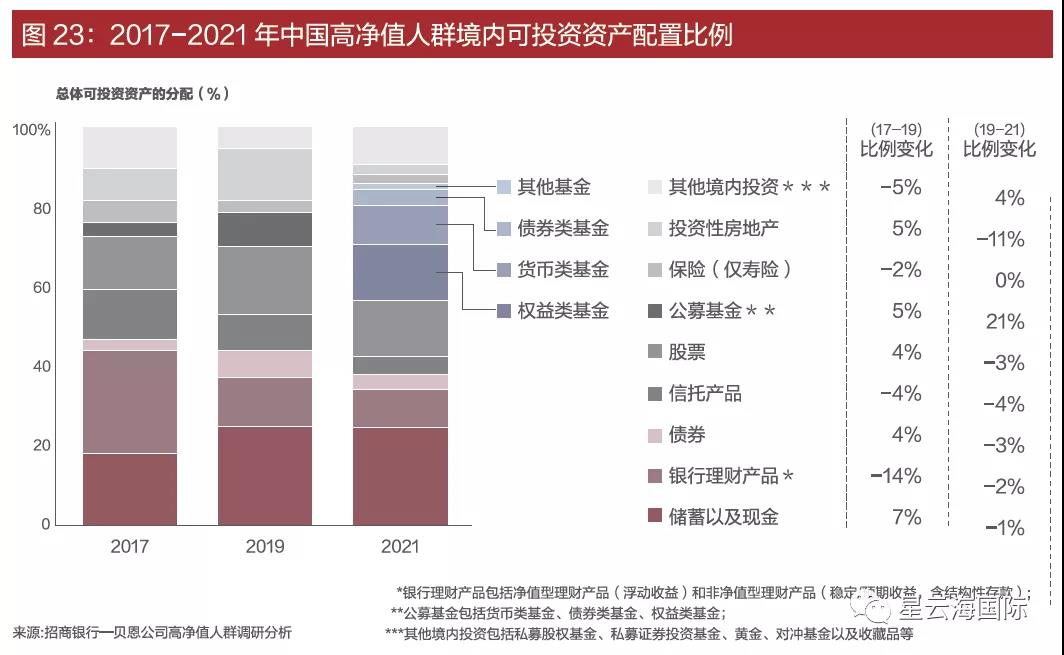

In the context of the steady growth of China’s economy and the shock and stabilization of the capital market, high-net-worth individuals still have a strong demand for continued growth in wealth in 2021, "Ensure wealth security" and "create more wealth" have become the two most important wealth goals for China's high-net-worth individuals.

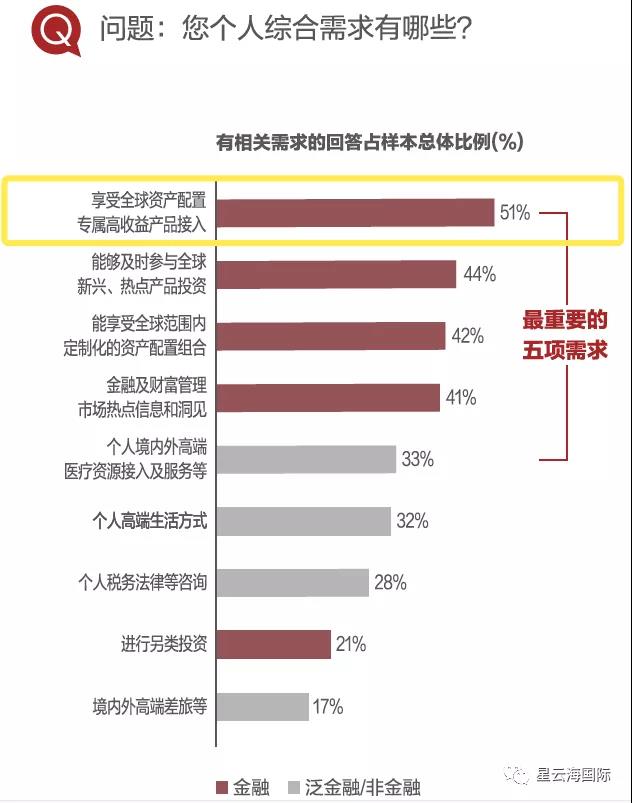

Personal comprehensive needs: "Global asset allocation" is the biggest demand of high-net-worth individuals

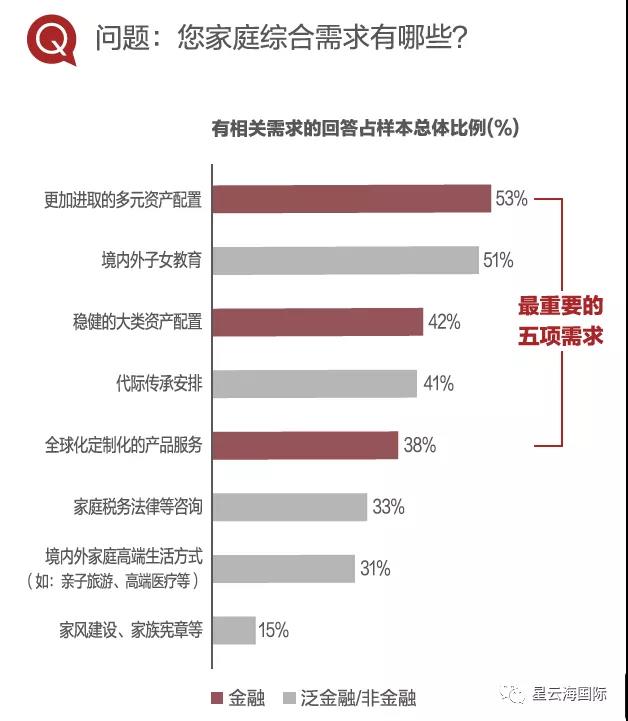

Comprehensive needs of the family: There is a stronger awareness of the allocation of multiple assets, and the family’s children’s education and intergenerational inheritance needs are urgent

Strengthening awareness of family inheritance

The acceptance of family office services is increasing

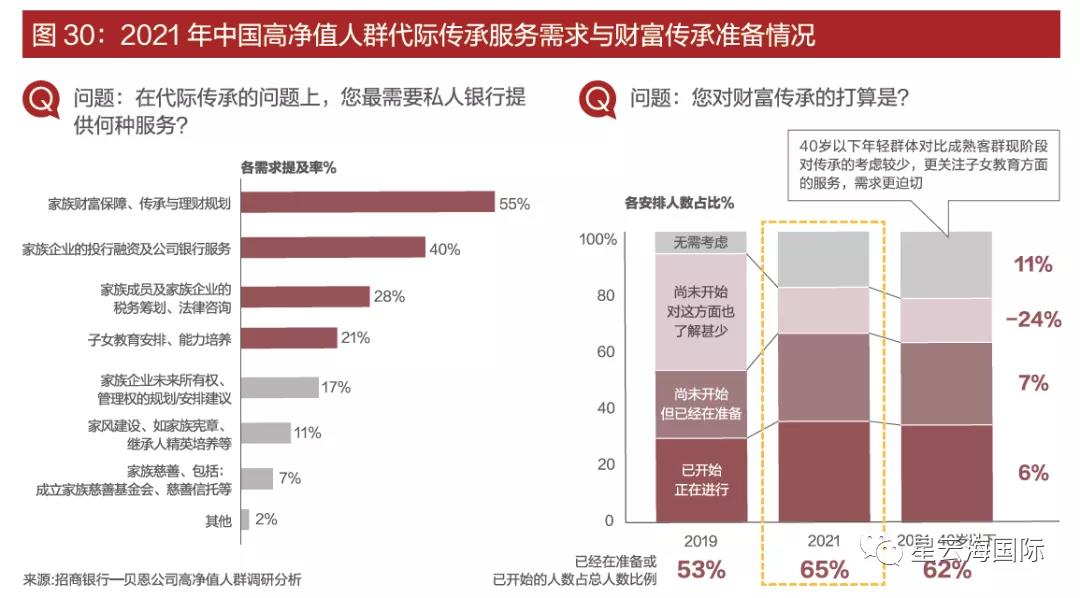

Under the influence of uncertain factors in the external environment, the importance of wealth inheritance is further highlighted, and the awareness of family inheritance among high-net-worth individuals is strengthened. In 2019, 53% of the high-net-worth individuals surveyed are already preparing or have begun making arrangements for wealth inheritance, and this proportion will rise to 65% in 2021.

High-net-worth individuals have a growing demand for family office services.

As the "jewel in the crown" of wealth management, the acceptance of family office services in 2021 has risen from less than 80% in 2019 to nearly 90%. In terms of wealth inheritance for high-net-worth individuals, the initial arrangement starts with real estate and insurance, and gradually matures and expands to family trusts.

Hong Kong is the preferred destination for overseas investment

And the preferred transfer station for overseas assets

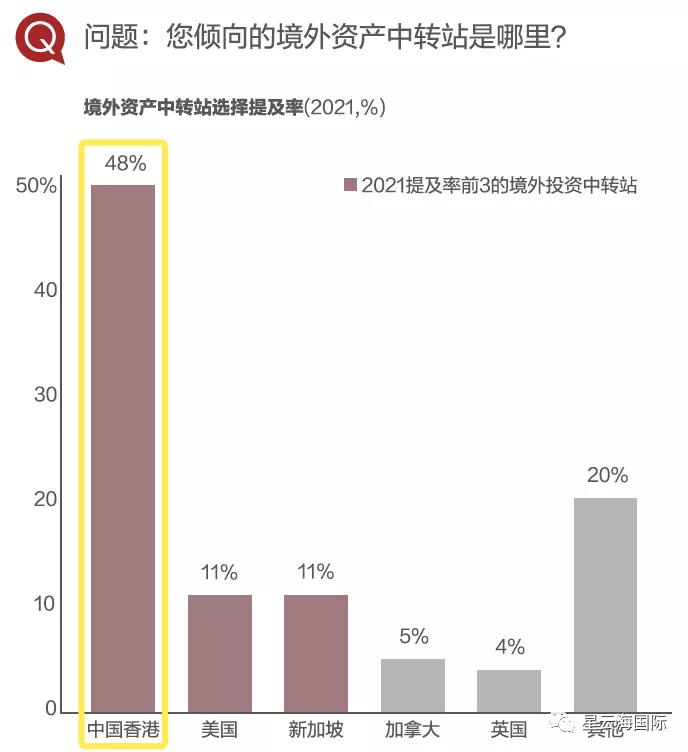

In 2021, Hong Kong, the United States, and Singapore will be the three overseas asset transfer stations with the highest mention rates.

Relying on its unique advantages in geographical location, financial market, human resources and asset allocation, Hong Kong, China, has become the link between the Mainland's capital market and the world. It is not only the preferred transfer station for overseas assets, but also the preferred destination for overseas investment.

Singapore's performance is also quite impressive, with the mention rate ranking among the top three.

At present, the primary goal of young high-net-worth individuals is still to continue to create and accumulate wealth, in order to ensure the safety of wealth and satisfy the high-quality life and children’s education On the basis of comprehensive needs and other comprehensive needs, asset allocation for subsequent wealth inheritance.

For the new generation of high-net-worth individuals, the entire chain of overseas assets has become a new trend, from a single investment plan to asset isolation and the establishment of legal structures for overseas investment.

Xingyunhai International has rich practical experience in overseas identity and asset allocation, and family wealth inheritance. We provide customers with "one-stop private customization, exclusive services". If you have related questions, please come to consult and discuss!

Xingyunhai International

SING YUN

Singapore Family Office

According to the relevant regulations of Singapore: Applicants set up a family office in Singapore and can incur a fee of S$200,000 per year. The family office can apply for Singapore permanent residency status for relevant persons.

By configuring and managing assets in Singapore, let family members serve as senior managers in the family office and obtain an EP Employment Pass (Employment Pass), about two years later Can apply for permanent residence status (PR) for the whole family.

Advantages of immigration to Singapore

★ Chinese liveable: 76% Chinese, the mainstream language is Chinese

★ Tax haven: no global taxation, no inheritance tax, no capital gains tax

★ Bilingual education: high-quality bilingual education environment, using Cambridge education system

★ Conducive to doing business: Once rated as one of the most suitable countries for doing business in the world

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece