In the post-epidemic era, more and more investors are adding spillover assets such as overseas real estate to reduce the risk of asset dilution caused by the money supply's "draft".

In an interview with 391 the world’s most influential real estate industry After market research, PricewaterhouseCoopers and the Urban Land Institute jointly launched the "2021 Asia Pacific Real Estate Market Emerging Trends" report .

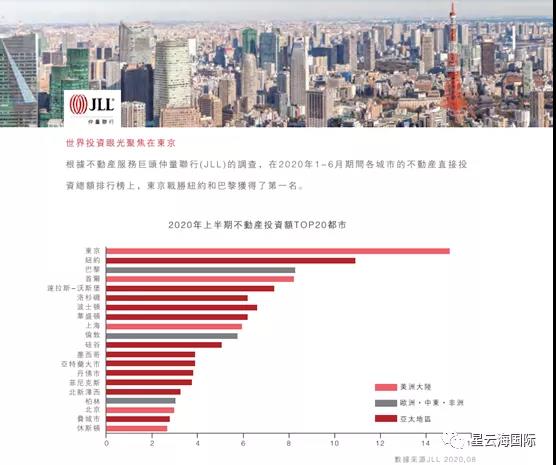

Without any suspense, Singapore is still in the hearts of investors, Tokyo and Osaka, Japan are high-quality investment destinations, and their urban development prospects and investment prospects are among the best in Asia:

![]()

No.1·Singapore

2021 the most promising cities for investment

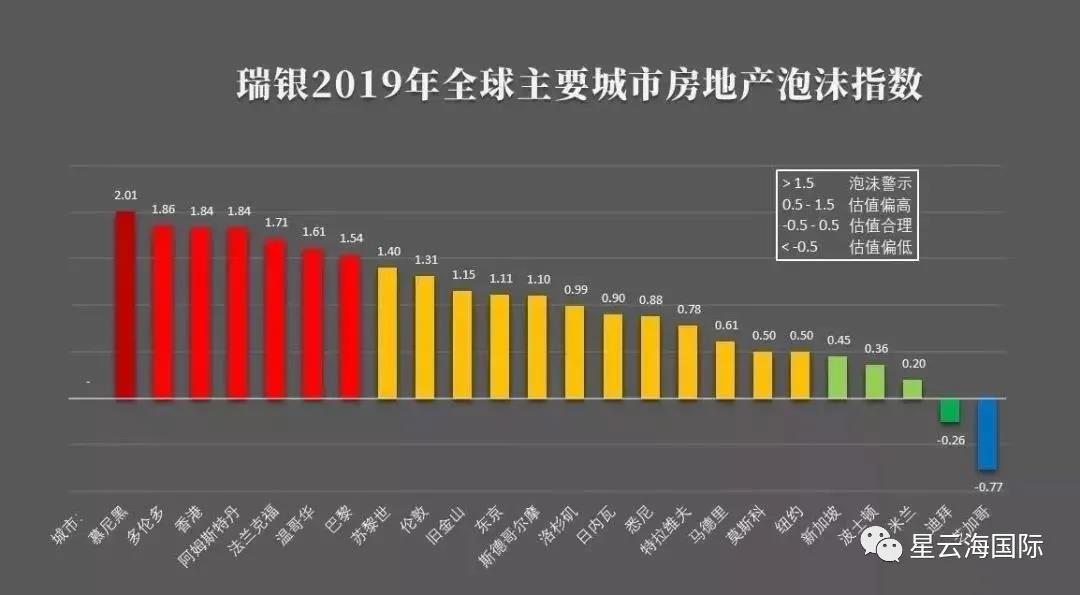

Among the 24 major cities in the world, the Singapore real estate bubble index is only 0.45%.

In 2020 only, 30% of luxury homes in Singapore have been bought by Chinese investors. Chinese investors have Become the first foreign buyer of a luxury house in Singapore.

Singapore is able to top the list again because it has qualities that other countries don’t have.

First, as the "Switzerland of Asia", Singapore has created a good safe haven image in the global environment.

This has attracted a steady stream of investors and companies focusing on Singapore. Many Chinese companies with local headquarters in Singapore choose to list in the Hong Kong Special Administrative Region and develop their business in Southeast Asia.

Whether it is the "Belt and Road" construction or RCEP, ASEAN is China's important regional cooperation partner. And Singapore can act as a channel, hub, and international platform.

From the perspective of international circulation, Singapore is indeed a support point for Chinese companies to go overseas.

In addition, Singapore has provided investors and companies with many attractive policy support in terms of global financial services and asset management. For example, Singapore Family Office.

No.2·Japan

2021 the most promising cities for investment

The big trend of hedging, high predictability, and considerable return on investment make the Japanese real estate market a must for investors.

One is that the yen is recognized as one of the safe-haven currencies, and the other is that Japan has tenants with ample cash flow and a mature domestic market.

With the holding of Tokyo Olympics, Osaka World Expo and other major international events, it will also lead Japan’s housing prices Land prices continue to rise. And thanks to Japan's long-term low interest rate level, it reduces the incentive for investors to gain income by increasing leverage.

The rental yield of real estate in Japan is high, especially in Osaka. According to the global ranking of long-term rental apartment rental returns, Osaka, Japan’s rental return rate is 5.91%, Ranked second in the world; Tokyo 5.76%, ranked fourth.

The Blackstone Group, a large US investment company, has successively invested in 600 billion yen to acquire real estate in metropolitan areas such as Tokyo and Osaka. , It can also reflect the hotness of the Japanese real estate market.

Compared with Tokyo, Osaka is the only special zone in Japan that can legally operate homestays 365 days a year. With the advantages of high value-added potential and high operating income, Osaka is a stop not to be missed for real estate investment in Japan in 2021!

Source | Urban Land Institute / PWC, general news; some of the pictures are from the Internet, the copyright is owned by the original author

Editor | KIKI

Xingyunhai International

SING YUN

Japan business management visa

Investors invest a certain amount of practical funds in Japan , You can obtain a "Japanese Investment and Business Visa" by opening a company in Japan, that is, obtaining a residence permit in Japan, and then achieving the goal of permanent residence or immigration to Japan.

Application conditions

? Over 20 Over one year old, with business management experience.

? established in Japan And to operate a company: invest no less than 5 million yen (equivalent to approximately 300,000 yuan) of registered capital to establish a company; have a fixed office in Japan; clarify the sustainable business content.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece