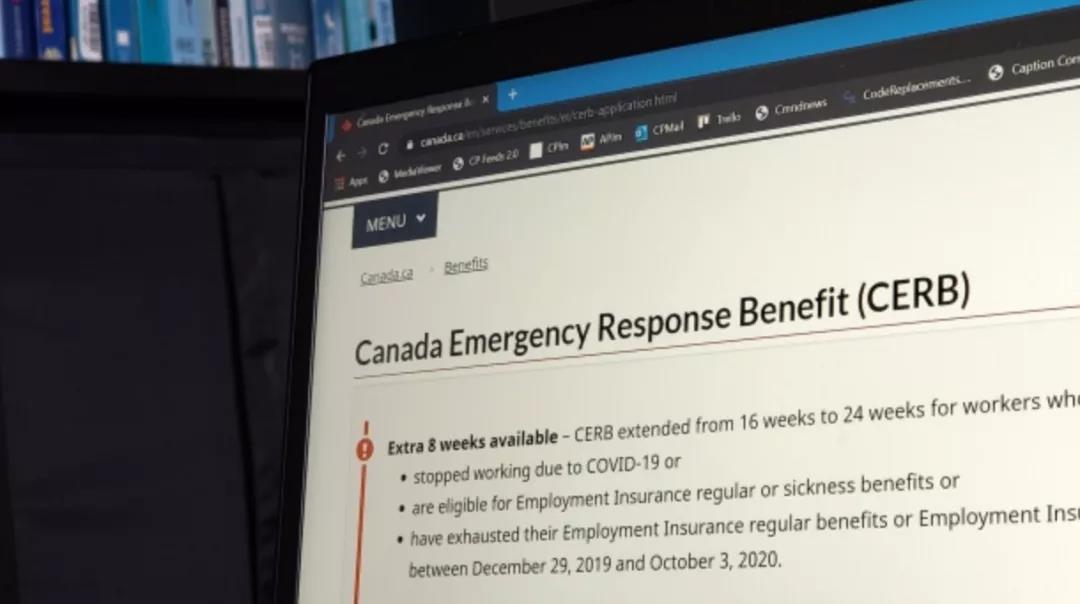

During the epidemic, the federal government helped many Canadians who lost their jobs or lost their income through CERB and CRB relief funds.

However, with the gradual restart of the economy and the distribution of relief funds, some workers are unwilling to go back to work, the labor force is difficult to recover, and the economic recovery is slow.

So in order to stimulate the labor force to return to the workplace, Canada recently expanded another benefit, 3.2 million Canadians will benefit from it!

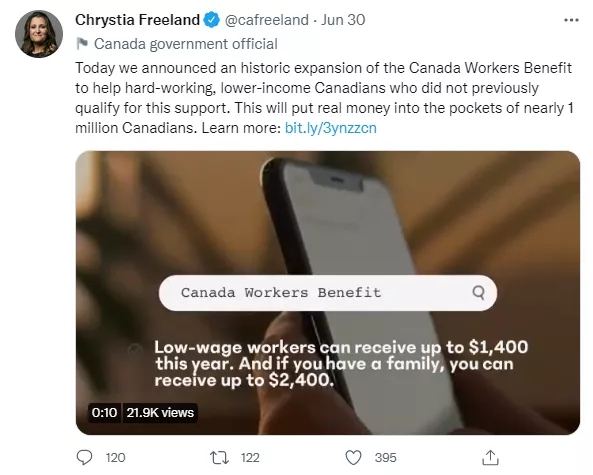

Recently, the Canadian Deputy Prime Minister and Minister of Finance Fang Huilan and the Minister of Middle Class Prosperity and Deputy Minister of Finance Mona Fortier jointly announced the Expansion of Canadian Workers’ Welfare CWB span> (Canada Worker Benefit), to provide more Canadians (about 1 million) and help nearly 100,000 people out of poverty.

The federal government will invest $8.9 billion in the next six years to expand the Canada Workers Benefit (CWB), Canada Workers Benefit is refundable Tax credits, to help individuals and families with low work incomes. For workers, this is a considerable tax refund.

So far, the eligibility threshold for this benefit has prevented many low-wage workers from enjoying it, which means that despite having full-time jobs, people still live below the poverty line. As the changes contained in the government budget are passed, the government now adds nearly 1 million low-income workers to qualify for tax rebates up to the following:

*Single workers without children (groups who do not receive many benefits), up to $1,400 Canadian dollars;

*Workers with families, up to $2,400 Canadian dollars;

*A total of approximately 3.2 million Canadians can receive this benefit.

During the epidemic, low-income workers are one of the groups that have been hit hardest. Economic recovery must start with the establishment of a strong workforce, which requires raising Canadian work income and addressing income inequality. The government is expanding the scope of eligibility for worker benefits by providing benefits to people whose income reaches the following income levels:

*Single Canadian with an annual income of less than $32,244 Canadian dollars and no children;

*Single-income households with annual income below $42,197 Canadian dollars;

*Double-income families with annual income below $56,197 Canadian dollars.

This expansion of the scope of benefits includes a new regulation that allows the second income earners of couples (mostly women) to calculate their eligibility for benefits. Subtract up to $14,000 Canadian dollars to allow more families to receive tax refund benefits.

Deputy Prime Minister Fang Huilan said: “The epidemic has highlighted the inequality suffered by low-income workers in Canada. They work harder than anyone else but have lower wages. In the past year, many people have faced layoffs and jobs. Significant risk of infection in places. I believe all Canadians will agree that people who work full-time in our country should not live in poverty. By strengthening worker welfare, we will help nearly 100,000 people out of poverty and help 1 million hard-working people Livelihoods of Canadians and build a fairer and more inclusive economic recovery."

Mona Fortier, Minister of Middle Class Prosperity and Deputy Minister of Finance of Canada, said: "By increasing this benefit, Canada will add another 1 million people. This will help nearly 100,000 people escape poverty."

The federal government stated that these changes mean that most full-time workers earning the lowest hourly wage will receive support through the CWB program. Low-wage families have more disposable income and provide incentives for Canadians to rejoin the workforce.

In addition to expanding CWB's welfare coverage, the federal government has recently launched a series of measures to strengthen Canadian worker welfare, including:

*The federal minimum wage is increased to 15 Canadian dollars per hour, rising with inflation

*Extend the Canadian Emergency Wage Subsidy (CEWS), Canadian Emergency Rent Subsidy (CERS) and related support to September 25, 2021

*The new Canada Recovery Hiring Program will provide alternative subsidies to companies affected by the epidemic to help them hire more workers or increase their working hours and wages

*The new Sectoral Workforce Solutions Program has helped up to 90,000 Canadians get the training they need to get good jobs in sectors where employers are looking for skilled workers

To view the basic introduction of Canadian worker benefits, eligibility for application and other information, please copy the link below and open it in a web browser:

https://www.canada.ca/en/revenue-agency/services/child-family-benefits/witb-eligibility.html

Saskatchewan entrepreneur immigration application requirements

★ EOI score meets the screening requirements

★ The main applicant and spouse obtain a two-year work visa, and the children obtain a student visa. The main applicant must start a business, and the spouse can work in Canada

★ After obtaining the work permit, follow the business plan to start a business in Saskatchewan. If you invest in Saskatoon or Regina, create at least 2 local employment opportunities (non-kinship)

Advantages of the Saskatchewan Entrepreneur Immigration Program

★ The project has no quota requirements, short cycle, low cost, and low investment (from 200,000 Canadian dollars)

★ While holding a work visa to start a business in Canada, the whole family will enjoy Canadian education, medical and other benefits

★ The project has a long history, stable policy and high success rate

★ Suitable for Chinese SMEs and self-employed merchants to apply

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece