1. Hua Xia Bank announced the suspension of personal foreign exchange trading business.

Recently, Hua Xia Bank issued an announcement on its official website stating: “In order to comply with the changes in the market situation, from 0:00 on December 1, 2021, our bank will suspend personal foreign exchange trading business, and the business recovery time will be notified separately. Please According to one's own needs, make corresponding arrangements for foreign exchange funds in advance."

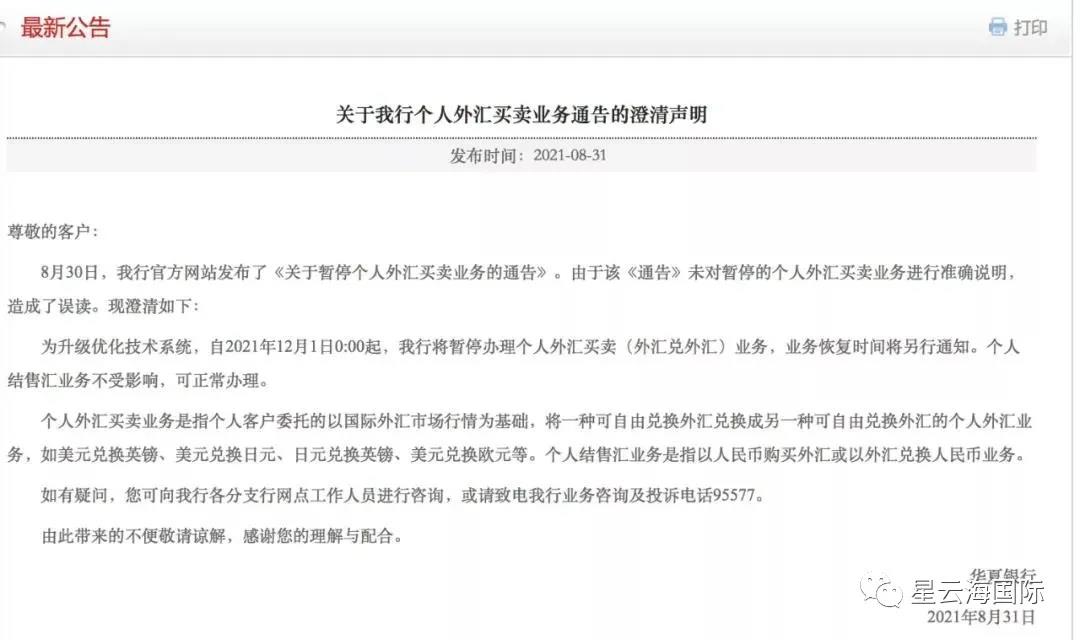

But soon Hua Xia Bank deleted this announcement and replaced it with a "Clarification Statement Regarding the Announcement of Our Bank's Personal Foreign Exchange Trading Business". He also stated that the bank's personal foreign exchange settlement and sales business will not be affected and can be handled normally.

The announcement stated:

In order to upgrade and optimize the technical system, starting from 0:00 on December 1, 2021, personal foreign exchange trading (foreign exchange against foreign exchange) business will be suspended, and the business recovery time will be notified separately.

![]()

Although the announcement of "suspending personal foreign exchange trading business" only "survived" for one day. However, this topic still appeared in the hot search on Weibo, causing heated discussions among netizens.

Second, the suspension is "foreign exchange against foreign exchange", not RMB exchange.

The business of personal foreign exchange settlement and sale refers to the exchange of renminbi with foreign exchange, or the conversion of foreign exchange into renminbi, and each person has an annual quota of 50,000 US dollars (or equivalent) to use.

For small-value exchange needs, in addition to going to branches, many banks have self-service channels in mobile banking or online banking channels, which is very convenient.

For this business, Hua Xia Bank's policy has not changed. As a matter of fact, the foreign exchange settlement and sale business of all banks is going on normally, so you don't need to be nervous.

The business that Hua Xia Bank ceased from December 1st is foreign exchange trading, in short, foreign exchange Exchange foreign exchange, such as the dollar to the euro, the dollar to the yen, the yen to the pound and so on.

3. Why suspend foreign exchange trading?

Many people exchange renminbi, mainly for current needs, such as the need to go abroad for shopping and study abroad. The difference is that foreign exchange trading has obvious investment and even speculative foreign exchange nature; of course, there is also a part of market demand for hedging.

Hua Xia Bank President Zhang Jianhua’s reply at the interim report performance conference was: “The current international economic situation is complex and the foreign exchange market is volatile. Our bank has comprehensively considered customer risk tolerance and other factors to suspend personal foreign exchange trading.”

In fact, in addition to Hua Xia Bank, ICBC, Postal Savings Bank, China Merchants Bank and other more than 20 banks have successively issued personal foreign exchange /span> and precious metal trading industrybusiness span>Make different levels of adjustments. Specific measures include suspending new account opening, raising the trading starting point, raising the risk level, holding position limits, and centralized termination of contracts.

Some banks also stated in the announcement that the precious metals market and foreign exchange market are relatively risky, and in the future they will further restrict precious metals and foreign exchange trading business, and recommend that customers do a good job in position management, reduce position balances in a timely manner, and control investment risks.

Bloomberg, a researcher on financial derivatives of Founder's mid-term futures, pointed out that the restriction of foreign exchange business and precious metal business is related to greater risks on the one hand, and the revision of the Basel Agreement on the other. In general, due to the “oil treasure” incident, banks’ participation in risky asset market making is restricted, and gradual withdrawal is also for ordinary investors. Good thing. Banks reduce the involvement of risky asset derivatives, which is also one of the measures to prevent systemic financial risks.

This state is interpreted by market participants as possibly the tranquility before the storm.

At present, global inflation expectations are heating up, US employment data is strong, and the prospects for global economic recovery are still uncertain. At the same time, the impact of the new crown epidemic on the economy is lingering. Sure.

In the face of the unpredictable development of the financial market, the planning of the second identity is particularly important. Projects such as Turkish citizenship by investment can simultaneously meet the multiple needs of emergency hedging, multinational counterparts, overseas education for children, and overseas home ownership. It is the current investor The wise choice.

Xingyunhai International

SING YUN

Turkish investment immigration

Passport benefits

★ Convenient travel, visa-free in more than 110 countries and regions worldwide

★ Children can easily attend international schools and enter Tsinghua Peking University without an exam

★ The second identity asset protection, helping to open overseas accounts and asset security configuration

★ The passport contains high gold content. Turkey is one of the candidate countries for the European Union. It has a clear goal to enter Europe within 5 years.

Investment method

★ Purchase real estate worth ≥250,000 USD (holding for 3 years)

★ Or deposit 500,000 US dollars into a personal account in a Turkish bank (deposit for 3 years)

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece