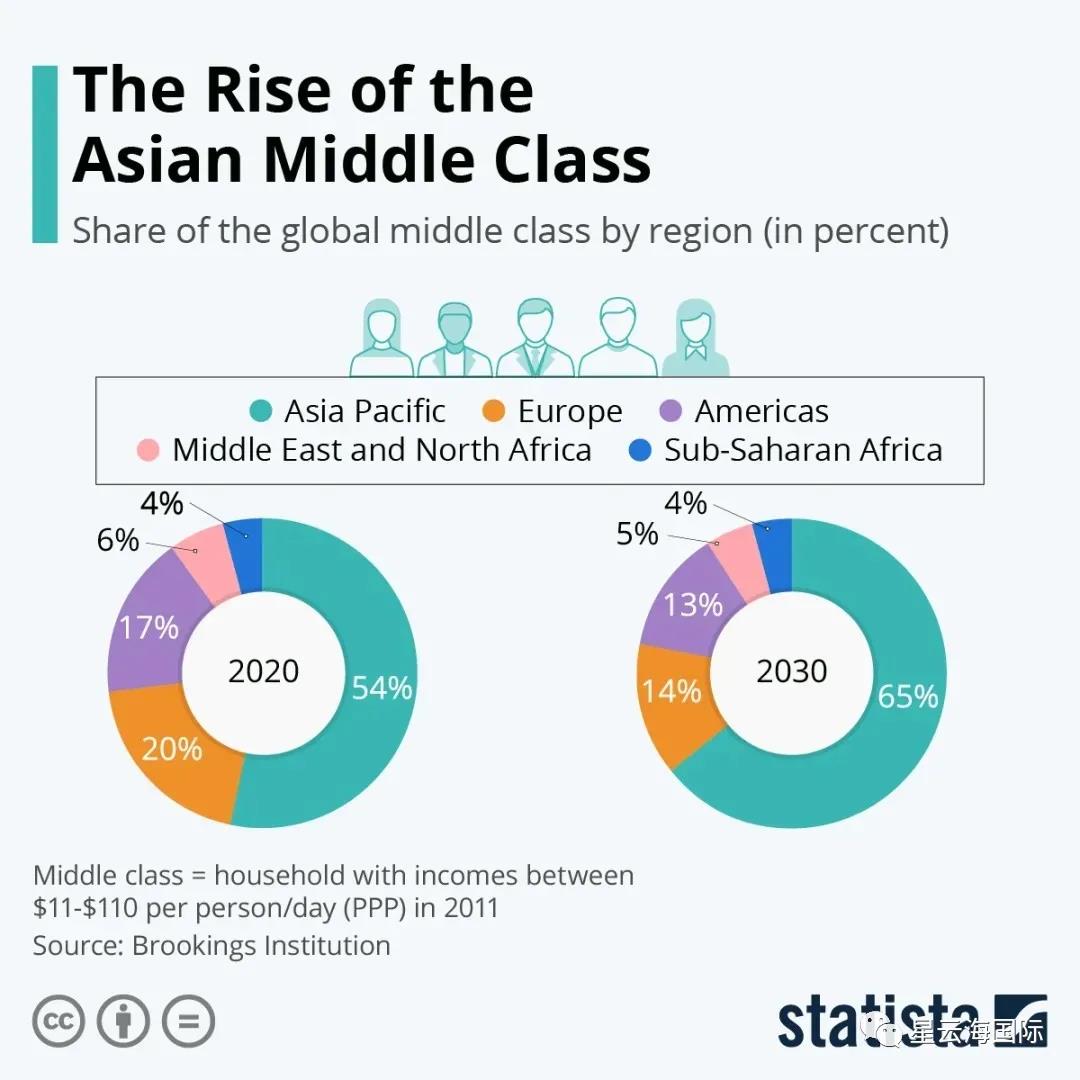

According to Bloomberg News, according to a new study, by 2030, more than 1 billion Asians will join the ranks of the global middle class.

According to data from the World Data Lab, the middle class refers to a family with a per capita daily income of between US$11-110 and currently there are approximately 3.75 billion people in the world.

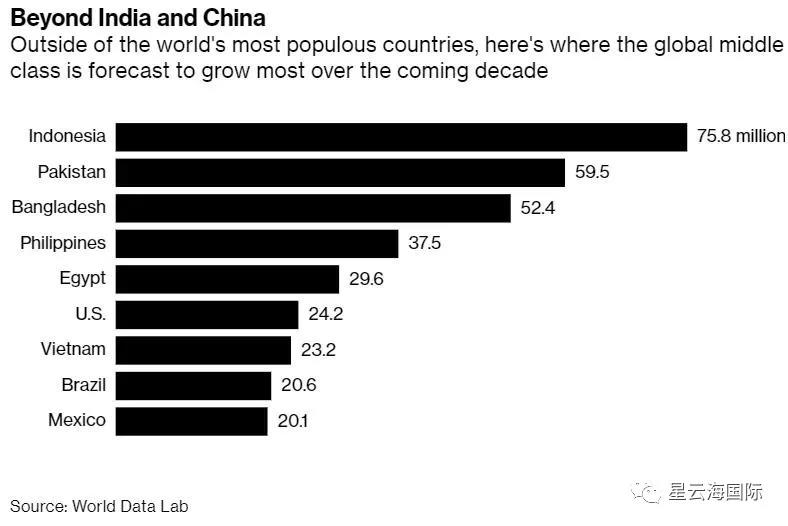

Data shows that China and India, two populous countries, will account for three-quarters of the new population (about 750 million people).

In addition to the rapid growth of the middle-class population in China and India, the regions with the fastest growth in the global middle-class population in the next ten years will also include: Indonesia, Pakistan, Bangladesh, the Philippines, Egypt, the United States, Vietnam, Brazil , Mexico.

Research predicts that although the new crown epidemic may pause the transformation of the world economic demographic structure, it is difficult to change this trend.

In addition, the study said: Asian countries already account for more than half of the world's middle class, but their consumption expenditures only account for 41%; By 2032, this proportion will exceed 50%.

According to forecasts, in less than 10 years, China will add 340 million middle-class It looks incredible, but it's not unrealistic.

From the perspective of economic development, according to the current economic development trend in China, if there are not too many uncontrollable factors interfere, more people will enter the ranks of the middle class.

At the same time, this is also related to national strategy. Improving the proportion of middle-income groups is exactly what China is striving for, including the recently discussed topic of shared wealth, which also points to this goal.

Achieving common prosperity means getting rich first and getting rich later. In addition to increasing the income of low-income people, reasonably control the "wealth of the rich" has become the key here.

Although common prosperity will not eliminate the income gap, For high-net-worth individuals and families, the future personal &family&corporate wealth and assets will undoubtedly face more diversified planning needs, and doing well in wealth inheritance and tax planning is becoming more and more important.

Xingyunhai International provides services such as immigration, overseas education, overseas investment, global asset allocation, family wealth planning, etc. Whether you want to learn about overseas identity allocation and immigration information, or you want to evaluate your personal situation and allocate overseas assets, we have professional consultation The consultant is at your service with enthusiasm. Please contact us if necessary!

Source: World Data Laboratory

Part of the image source network, only for sharing. If there is any infringement, please contact to delete

Xingyunhai International

SING YUN

Singapore Family Office

According to the relevant regulations of Singapore: apply People set up a family office in Singapore and can incur a fee of S$200,000 per year. The family office can apply for Singapore permanent residency status for relevant persons.

By configuring and managing in Singapore Assets, allow family members to serve as senior managers in the family office, obtain an EP Employment Pass (Employment Pass), and apply for permanent residence status (PR) for the whole family after about two years.

; Advantages of immigrating to Singapore

★ Chinese liveable: 76% Chinese, the mainstream language is Chinese

★ Tax haven: no global taxation, no inheritance tax, no capital gains tax

★ Bilingual education: high-quality bilingual education environment, using Cambridge education system

★ Conducive to doing business: Once rated as one of the most suitable countries for doing business in the world

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece