Recently, the international exchange rate market has attracted high attention from investors, and the importance of diversified asset allocation has once again become a hot topic.

Among various overseas investment products, real estate projects are favored by the market due to their strong resistance to pressure and risk diversification. In the current overseas real estate market, Turkish real estate investment is particularly sought after!

Why is the Turkish real estate market so hot?

Xiaoxing will analyze the three major reasons why Turkish real estate is so popular.

Turkey's real estate continues to boom in 2021

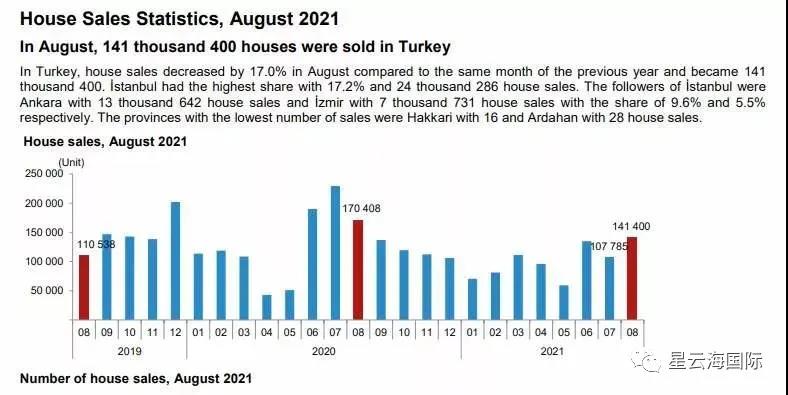

According to the house sales statistics released by the Turkish National Bureau of Statistics, Turkey sold a total of 141,400 units in August 2021, continuing to maintain a strong growth trend!

It is worth mentioning that Chinese buyers entered the top 20 and purchased 98 properties.

Istanbul is still the top seller.

As the real estate market rebounded from the impact of the coronavirus pandemic, foreign buyers purchased a record number of residential properties in Turkey from January to August this year.

According to data from the Turkish Statistics Agency (TurkStat), foreigners bought 5,866 sets of real estate, an increase of 50.7% over the same period last year; from January to August this year, the total number of foreigners buying houses increased by 47.6% over the same period last year!

The economic prospects are broad and have attracted much attention

As a European country with fast economic growth, Turkey enjoys the reputation of "the country of new diamonds" in the international community!

During the global epidemic, Turkey's economic performance is still outstanding!

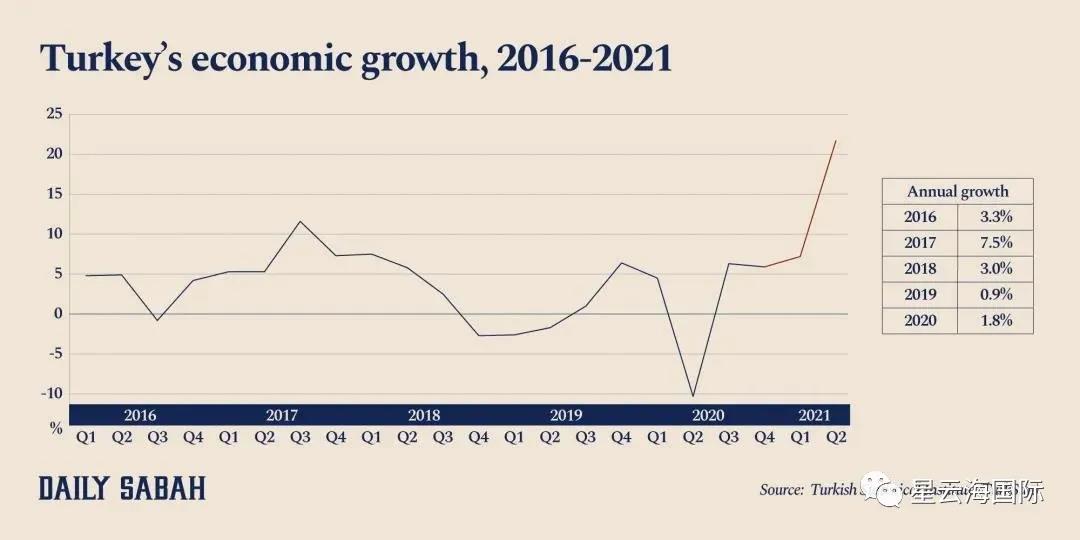

According to official statistics from the Turkish Statistics Agency (Turk Stat), the gross domestic product (GDP) increased by 21.7% year-on-year from April to June, which was the highest figure since 1999.

Wall Street investment banks JPMorgan and Goldman Sachs also raised their forecasts for Turkish economic growth. JPMorgan Chase stated that it has revised its GDP growth forecast for 2021 from 6.8% to 8.4%. It will keep its forecast for 2022 unchanged at 3.4%. Goldman Sachs further raised its forecast for 2021, from the previous 7.5% to 9.5% year-on-year.

In fact, in a recent assessment, the international credit rating agency Moody's raised Turkey’s economic growth forecast for 2021 from 5% to 6%. In its 2021-22 global macro outlook report, it also revised its growth forecast for 2022 from 3.5% was revised to 3.6%. Moody's pointed out that due to the continuous recovery of the global economy and progress in vaccination, the restart of Turkey's tourism industry has supported its economic growth. Due to the high base effect and the continued recovery of economic activities, the international credit rating agency Fitch Ratings also raised Turkey’s growth forecast for this year from 6.3% to 7.9%, and once again upgraded Turkey’s credit rating to "BB-" with a rating outlook of " Stablize".

In its statement, Fitch pointed out that “l(fā)ow government deficits and debt, stronger growth performance and structural indicators” are a huge advantage for the Turkish economy. Turkish economists said in a report: “In general, the Turkish economy is growing faster than we thought, and its external balance has not deteriorated because the rebound in foreign demand is very supportive.

Attractive, ushering in a good time to invest in Turkey

Turkey spans two continents, Asia and Europe, and implements the European model in political, economic, cultural and other fields. It is a candidate country of the European Union, a founding member of the Organization for Economic Cooperation and Development, and a member of the Group of Twenty.

With the rapid development of the Turkish economy, many foreign companies have also seen Turkey's investment potential. Since 2021, many internationally renowned companies including Alibaba, Xiaomi, TCL, OPPO and other Chinese companies, as well as European countries such as the United Kingdom, Germany, and Italy, have started or increased their investments in Turkey.

During the epidemic, Turkey launched a "package" loan program, prompting many local Turkish people to buy houses through loans. Turkey's housing loans broke the annual record in just 6 months. According to data from the Banking Regulatory Authority (BDDK), in the first half of this year, the total balance of real estate loans in Turkey reached 33.63 billion U.S. dollars, an increase of 4.69 billion U.S. dollars compared with the same period last year.

All in all, the current Turkish economy is stable, the investment environment is relatively mature, and the government cuts interest rates and other favorable factors, it is a good time to enter the Turkish market!

Turkey’s US$250,000 investment in real estate naturalization project has multiple advantages such as short approval cycle, visa-free multi-country, "real estate + identity" double income, springboard to the United Kingdom and the United States, etc. If you want to achieve overseas real estate allocation, immigration status, global access, With multiple demands such as Anglo-American education, Turkish citizenship by investment projects are worth considering.

As the advantages of Turkish citizenship by investment projects become increasingly prominent, there will be a large number of investors entering the market, and Turkish housing prices will also rise accordingly. Friends who have investment real estate needs, please plan as soon as possible!

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece