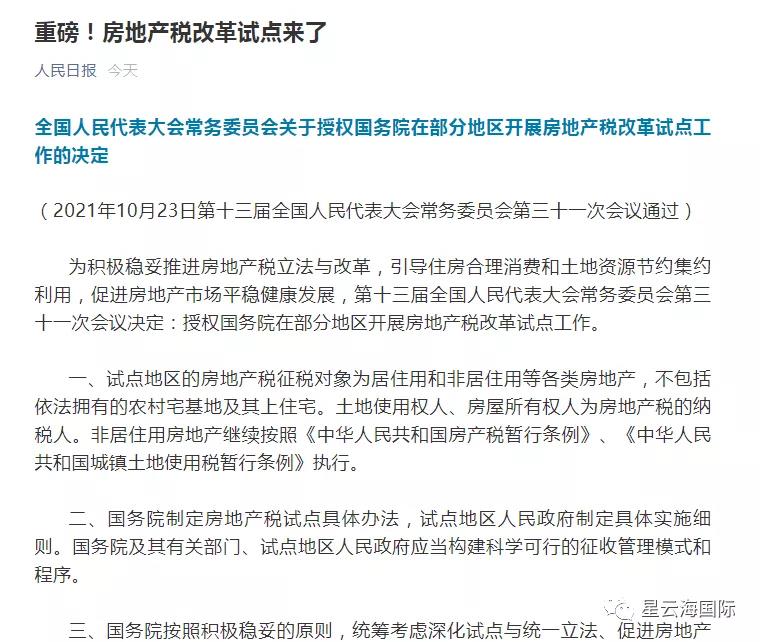

The real estate tax boots finally landed.

On October 23, there was a very important piece of news: The National People's Congress authorized the State Council to carry out a pilot real estate tax reform in some regions.

In the past ten years or so, people have never stopped discussing real estate tax, but the difference is that in the past, people discussed "levying or not", now they are discussing "when will it be taxed" or "which cities will tax first." ".

So most people have gradually expected it. The introduction of real estate tax is inevitable, no matter from the rules of urbanization or the need for common prosperity.

But when will it be released and what rules will be used to release it remains to be seen.

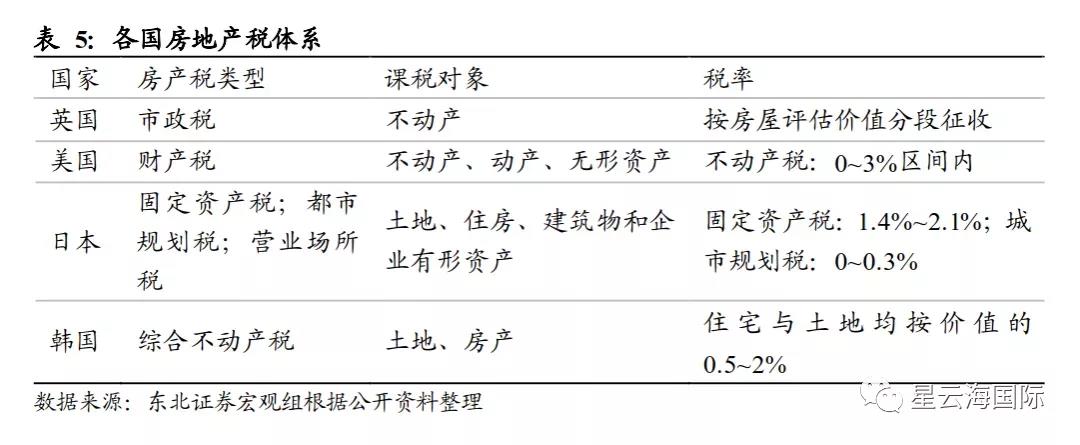

From a global perspective, real estate tax is a tax with a long history.

Currently, many countries have imposed different forms of real estate taxes.

1. Among the 38 OECD member countries:

Except for Belgium and Israel, other countries have imposed different forms of real estate taxes.

2. Among the 27 member states of the European Union:

Only Malta and Cyprus did not levy real estate taxes.

3. Among the G20 member states:

Only South Africa does not levy a real estate tax.

4. Among the BRIC countries:

Only South Africa does not levy a real estate tax; most countries with economies in transition levy real estate tax.

How do the United Kingdom, the United States, Japan and South Korea collect real estate taxes? Please see the picture below:

However, it is worth noting that the domestic real estate land belongs to the country, and as an individual only owns the right to use the house for 70 years.

Most overseas real estates are freehold property rights, and the land is owned by individuals. After investors buy the real estate, they can be passed on from generation to generation and become a real "real estate" in the true sense.

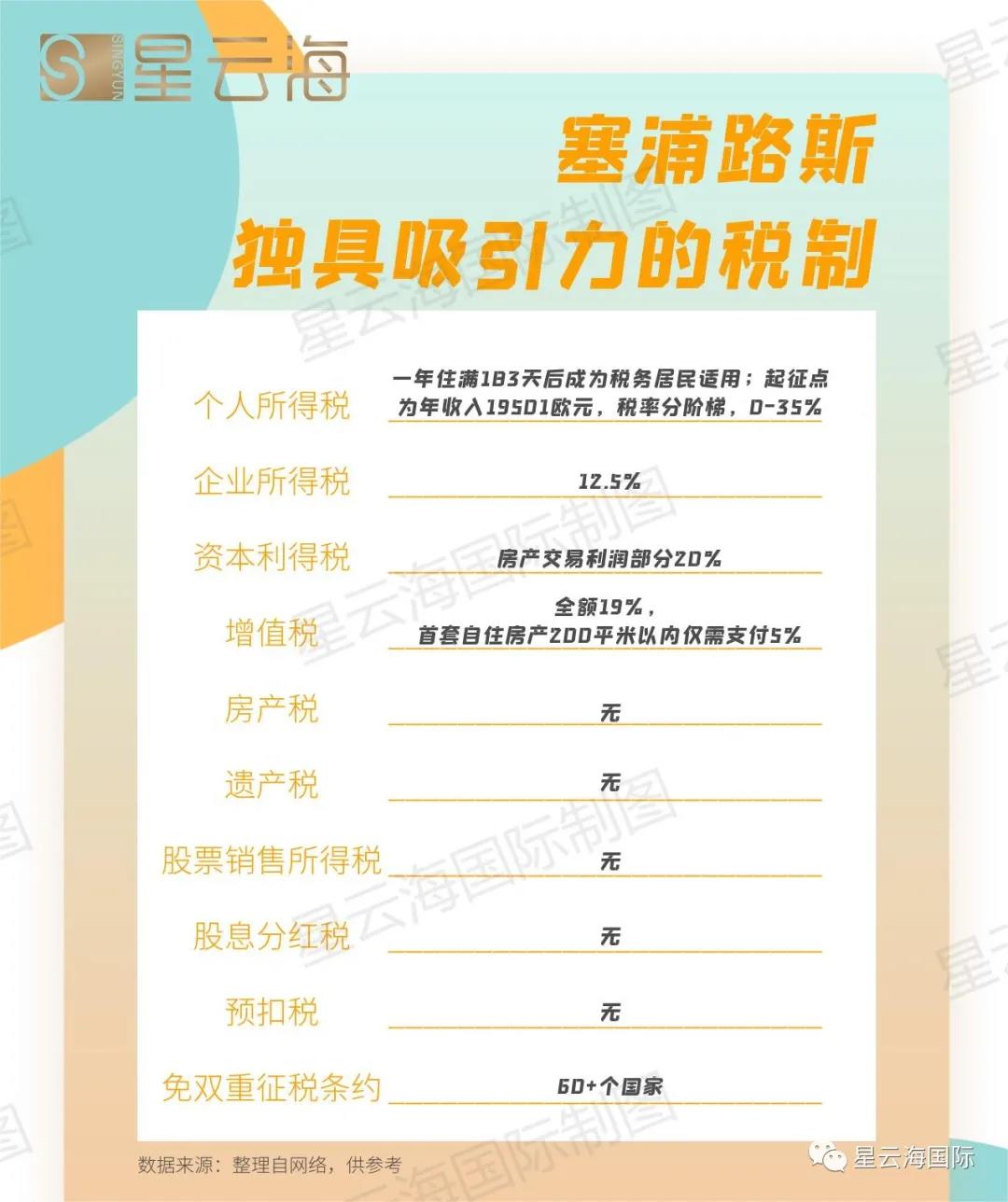

Take Cyprus as an example.

Cyprus has the lowest tax rate in the European Union, and its tax advantages are particularly obvious.

The top comprehensive casino resort in Europe operated by the Macau gambling king Ho's family here is about to be completed.

In choosing Cyprus, in addition to considering the advantages of geographical location, there may also be tax reasons.

Melco International Cyprus

As we can see from the chart below, Cyprus does not have property tax, inheritance tax, stock sales income tax, dividend tax, and withholding tax.

In order to attract investors, the Government of Cyprus has provided a 14% tax rebate for the first freehold property purchased in Cyprus from August 6, 2012. In other words, you can enjoy a preferential value-added tax rate of 5% for the purchase of the first house

Limassol Marina, Cyprus

Taking into account the low cost of buying a house, freehold property rights, investment income, geographical location, children's education, economic prospects, tax planning and other advantages, many investors from the UK and China choose to purchase 1 or N properties in Cyprus.

Not only that, when buying real estate in Cyprus, you can also apply for permanent residence (PR) status and residence card at the same time.

The Cyprus Residence Card is permanent, a lifetime permit, and no residency requirements. It is the only country in Europe that has permanent residency status and can enjoy comprehensive free medical care. After meeting the residence requirements, you can apply for naturalization to obtain citizenship and a passport.

Xingyunhai International Cyprus Real Estate Project Listing Appreciation

The charm of overseas real estate lies in:

1. On the one hand

Most of the overseas real estate is freehold property rights. Identity planning and asset allocation are a win-win situation, which is the best choice for Chinese investors' asset inheritance.

2. On the other hand

Changes in exchange rates will also affect investors' assets, and global asset allocation has also become the consensus of more and more investors.

Whether it is policy regulation or the promotion of real estate tax, it can be seen that many people who are accustomed to real estate investment in China may lose this investment market.

You might as well look to the broader overseas market and win more possibilities for your life.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece