In December, the Hurun Research Institute released the "2021 China High Net Worth Group Wealth Risk Management White Paper".

The white paper shows that high-net-worth individuals have more advanced awareness and actions in wealth risk management.

Regarding the risk management measures and challenges they have embarked on in their business operations, asset allocation, children's education and health care plans. What kind of discoveries and interpretations are there?

"White Paper" Core Discovery of Enterprise Management

Over 90% of entrepreneurs are facing internal and external two-way risk challenges

Market changes risk the most attention

Affected by the epidemic, business owners have generally faced challenges from external risks (95%) and internal risks (90%) in the daily operations of their companies regarding the operating conditions of the past three years. 29% of entrepreneurs are already considering the risk of the company's inheritance to the next generation.

Almost all entrepreneurs believe that it is necessary to implement a "home-business isolation" system to provide family members with security of life when the company faces financial risks. Entrepreneurs hope to shift the focus of assets to the family at the right time and give priority to ensuring the stability of the family.

At present, in addition to sorting out the separation of high- and low-risk assets of corporate assets (61%), entrepreneurs have established family trusts (28%), invest in overseas markets, and purchase overseas assets (10%) have become an emerging way to protect family assets and the quality of life of their families.

Asset Allocation of "White Paper" Core Discovery

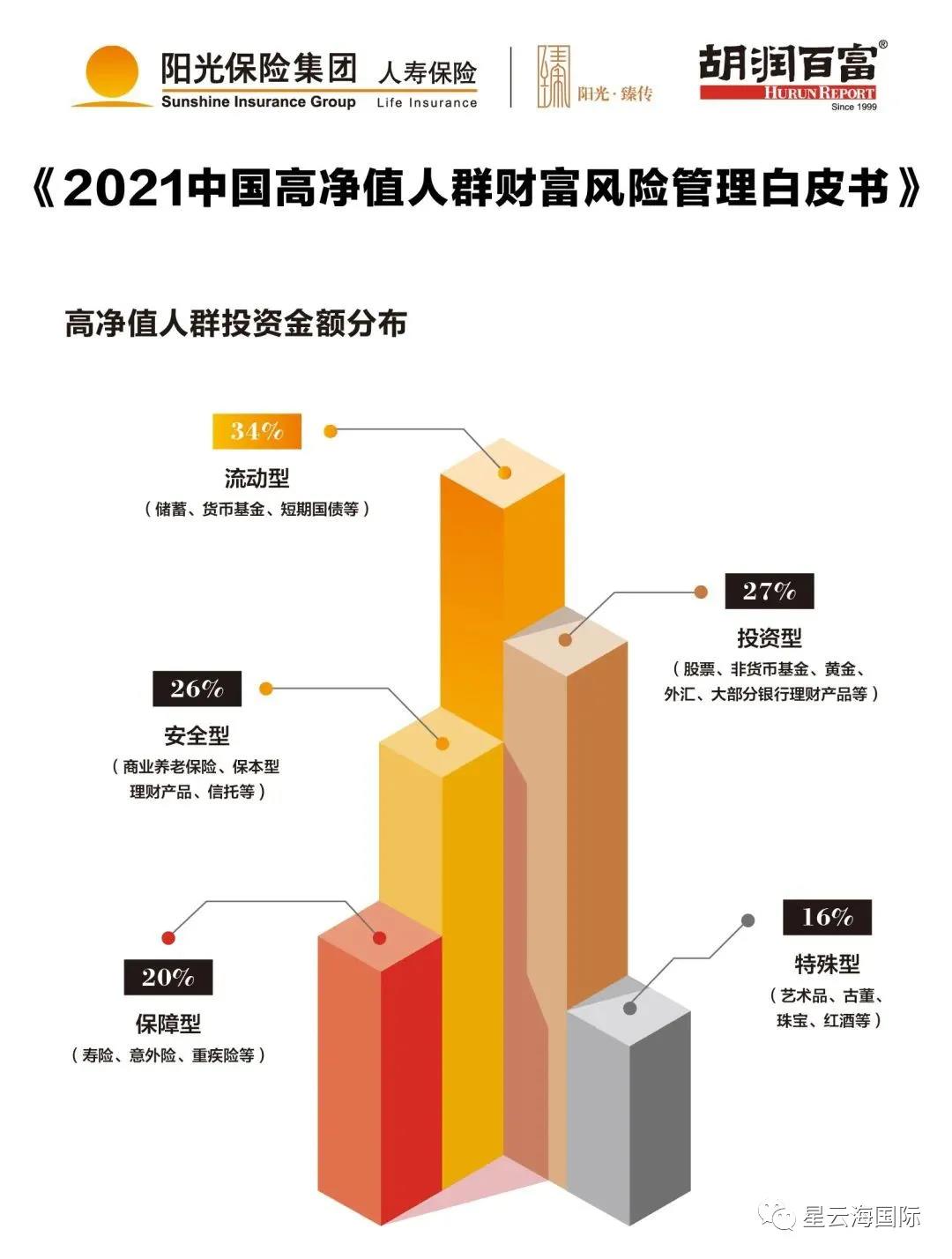

Diversified asset allocation of China's high-net-worth individuals

Highly liquid financial products are the most popular

In terms of the allocation ratio, 34% of the funds of high-net-worth households are used for the allocation of liquid financial instruments. In terms of the proportion of investors, 93% of high-net-worth individuals have invested in liquid financial assets including savings, currency funds, and short-term government bonds.

Long-term security investments and high-return investments are also widely used financial allocation methods for high-net-worth families. Focus on savings and currency funds in liquid products, life insurance and commercial pension insurance in safety products, and stocks in investment products.

Children's education found at the core of the "White Paper"

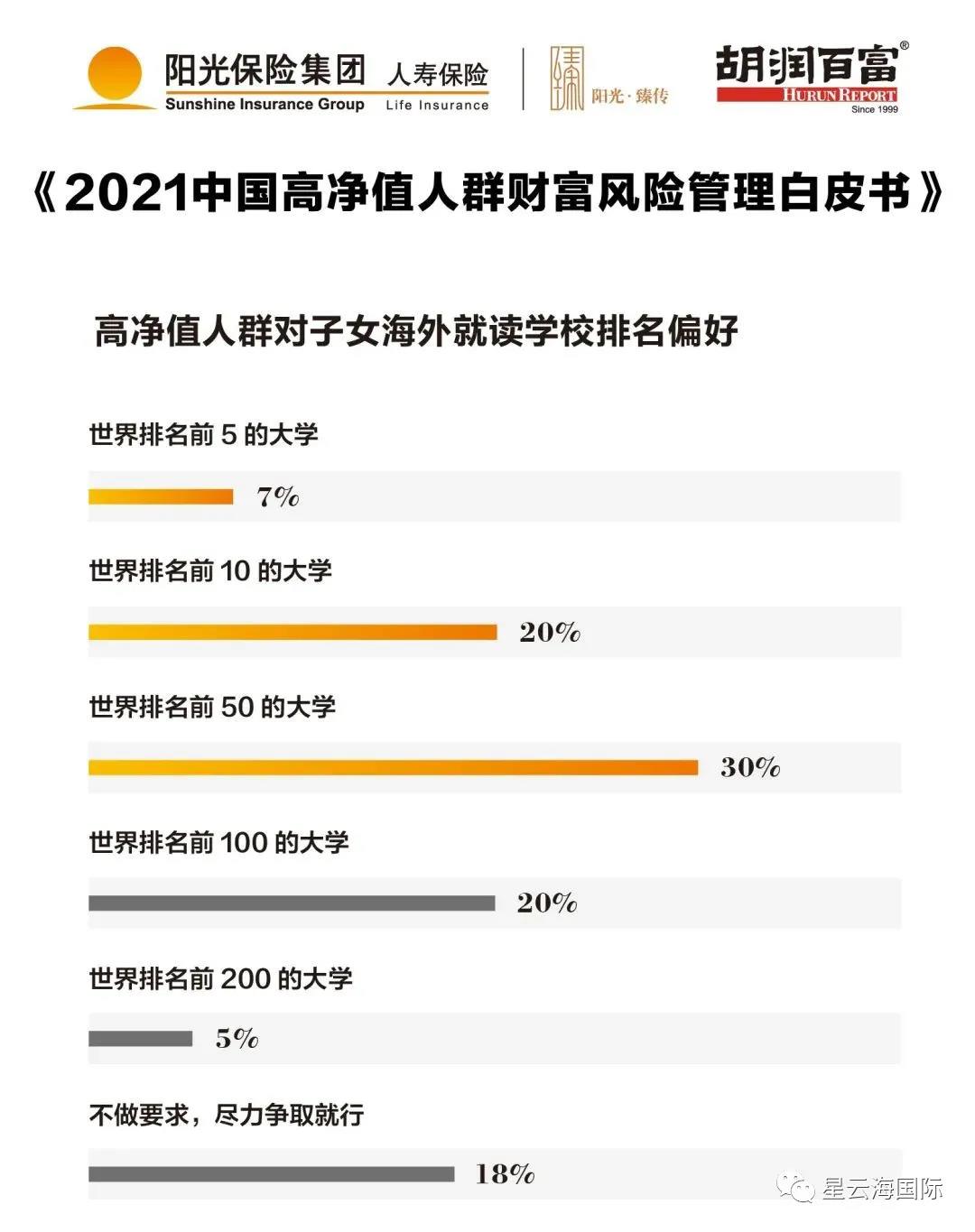

More than half of children from high-net-worth families target the top 50 universities in the world

The average willingness to pay for the entire education stage is nearly 4 million

Nearly 80% of high-net-worth individuals tend to send their children overseas for education, mainly considering the high school (18%) and undergraduate (26%) education stages as the starting point for overseas study. Overall, 82% of high-net-worth individuals pay attention to the world ranking of their children's school, and 57% of parents hope their children will enter the world's top 50 universities for further studies.

In terms of total investment in children’s education, the average high-net-worth group is willing to spend 3.92 million yuan for each child’s full academic stage. Nearly one-fifth of high-net-worth families are prepared to invest more than 5 million yuan in the entire education of their children.

"White Paper" Core Discovery of Health Care Management

59% of respondents hope to retire at the age of 55-65. "Travel" is a retirement plan that everyone must talk about. Regarding medical issues, 47% of the respondents believe that top experts are scarce and difficult to seek medical care.

There is such an open secret hidden in the major wealth rankings: more and more high-net-worth individuals are or have already reached an identity plan. Satisfy the desire to realize wealth inheritance, global convenience, help children's education, and global asset allocation.

Taking precautions, Nebula International can plan for you to enter, attack, retreat, and defend Plan B, so that you can solve problems such as avoiding risks and lifting restrictions.

So, have you done Plan B?

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece