Recently, the Legislative Council of the Hong Kong Special Administrative Region passed the Tax Incentive Bill for Single Family Offices (hereinafter referred to as the "Family Office Tax Incentive Bill"). According to the Family Office Tax Incentives Act, investment profits will be exempt from tax in Hong Kong provided certain conditions are met.

The passage of the bill is warmly welcomed by high-net-worth individuals and their families. Setting up a family office in Hong Kong can not only benefit from Hong Kong’s strong talent pool, sound legal system, leading private equity and venture capital markets, but also benefit from tax incentives. Policy to gain certainty of tax exemption on investment profits.

01

Advantages of Hong Kong family office tax incentives

The main features of Hong Kong family office tax incentives are as follows:

★ Investment profits from qualifying assets (such as securities, bonds and funds) are exempt from profits tax.

★ Incidental income (such as bond interest income) generated during the holding of qualifying assets is also exempt from profits tax (subject to a 5% limit).

★ There is no license requirement for Hong Kong single-family offices that only provide services to families.

★ There is no need to apply or pre-approval to enjoy the tax benefits of family office. Qualified family offices can conduct a self-assessment, and then report in the profit tax return according to the circumstances in which they can enjoy the tax benefits of the family office.

★ There is no local investment requirement, and the family office can choose to invest globally.

★ There are no requirements for hiring local employees (for example, employees need to be permanent residents of Hong Kong), and there is no restriction on whether employees are family members.

What income is tax-exempt under the family office tax incentive?

Investment profits from qualifying assets are tax-free. Eligible assets cover most financial products (such as securities, bonds and funds).

Incidental income generated during the holding of a qualifying asset is also exempt from tax, provided it does not exceed 5% of the gross income generated by the qualifying asset. Common incidental income includes interest income.

02

Qualified Single Family Office

Family Office (FO for short) can be divided into Single Family Office (SFO for short) and Multi Family Office (MFO for short).

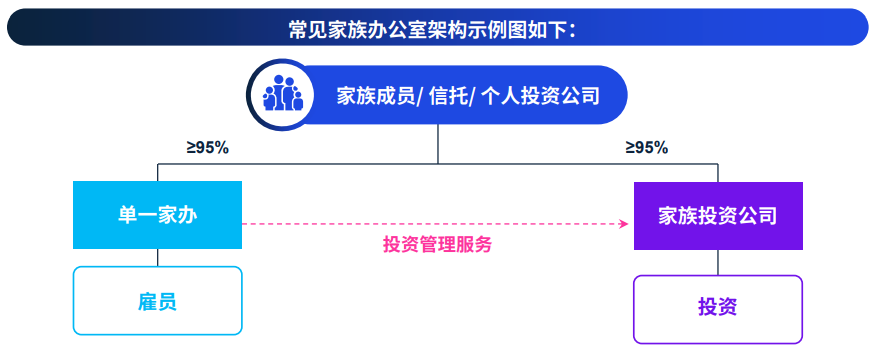

SFO refers to an office established by a family alone to serve only one family. The office is controlled by the family members and manages the family wealth by hiring professional members. Compared with MFO, SFO is more private and customizable, and has higher management costs.

In order to apply this preferential act, SFO must meet the following conditions:

★ The total size of qualified family assets under management (hereinafter referred to as "AUM") is at least HK$240 million.

★ The shareholding or beneficiary ratio of family members to a single family office is at least 95%. This ratio can be reduced to 75% if the remaining 25% is held by charities that are tax-exempt through section 88 of the Inland Revenue Ordinance.

★ A single family office is usually managed or controlled in Hong Kong.

★ No less than 75% of profits must come from services provided to family investment companies (and their special purpose companies) (such as investment management fees from family investment companies, service fees from family members, etc.).

Note: The Bill will be gazetted to take effect on May 19. The tax relief is applicable for tax years commencing on or after 1 April 2022.

Due to Hong Kong's unique simple tax system and low taxation, it has sufficient advantages in attracting investors to set up family offices in Hong Kong.

On March 24, 2023, the Hong Kong Special Administrative Region Government issued the "Policy Declaration on the Development of Family Office Business in Hong Kong", which indicated that the Hong Kong government has designated the work of attracting family offices to Hong Kong as a strategic key project, and also confirmed the determination of the Hong Kong government:

In addition to the international financial center, the Hong Kong government will create more diversified and comprehensive favorable policies to attract high-net-worth individuals and their family offices to settle in Hong Kong.

Following the upsurge of home office in Singapore, Hong Kong's home office field is ushering in its own bright moment in 2023! With its unique advantages, Hong Kong is the perfect choice for family offices looking for long-term investment goals.

Xingyunhai International is headquartered in Hong Kong, China, occupying regional advantages and possessing strong resources. Professional consultants, senior copywriters, and post-service teams follow up the whole process, providing comprehensive and considerate services such as Hong Kong immigration, further education, and investment.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece