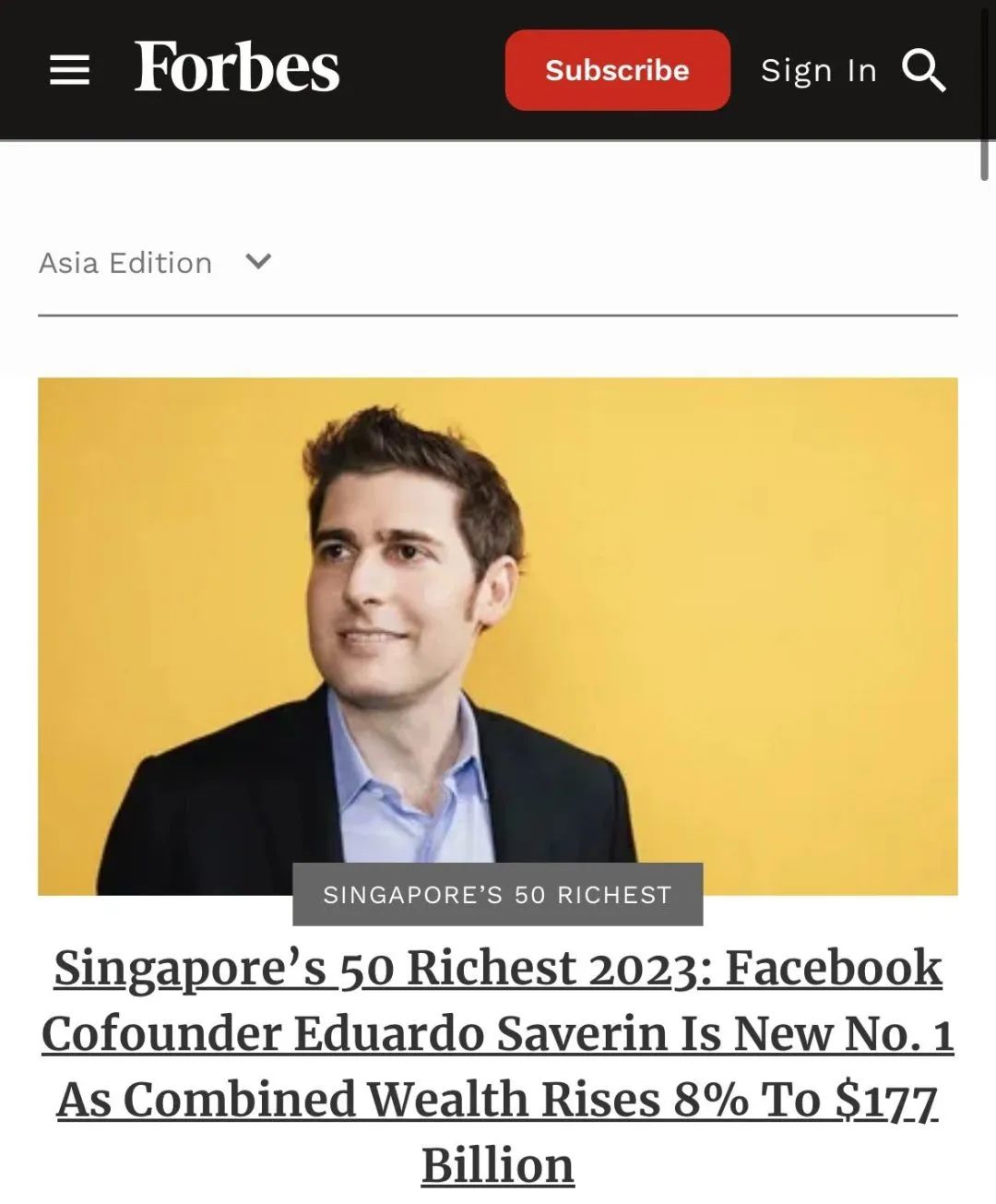

On September 7, 2023, "Forbes Asia" announced the high-profile list of the top 50 richest people in Singapore.

Eduardo Saverin, co-founder of Meta Platforms (formerly Facebook), topped this year’s Singapore rich list with a fortune of US$16 billion.

Top 20 richest people in Singapore

Far East Institution brothers Huang Zhixiang and Huang Zhida successfully held on to second place, with their wealth slightly falling to US$14.8 billion from US$15.2 billion last year.

Li Xiting, the founder and chairman of Shenzhen Mindray Medical, slipped from the top spot last year to third place, and his personal wealth dropped from US$15.6 billion to US$14 billion this year.

Wu Qingliang of Nippon Paint fell one place on the list to fourth, with his wealth falling from US$13 billion last year to US$12.3 billion this year.

Most immigrants from overseas

If you look closely, many of the identities on the ranking list are wealthy immigrants from other countries. In addition, Singapore is highly regarded by major companies around the world.

As early as 2019, the founder of Dyson moved the global headquarters to Singapore. This was not only an exquisite arrangement of business layout, but also wrote a glorious chapter of the family office here.

In June 2023, Siemens announced that it would invest 200 million euros in building a new factory in Singapore, which is expected to be put into production within 2 to 3 years.

Recently, Norges Bank Investment Management Company also intends to "move to a new home" and move its Asian operations center to Singapore.

Why can it attract so many wealthy people to gather here?

What is the charm of Singapore that attracts wealthy people from all over the world to gather here?

★Excellent business environment

Singapore, a politically and economically stable society governed by the rule of law, shines with its superior business environment.

Talent elites from all over the world gather here and become a dazzling gathering place for international talents.

Not only that, Singapore's company and trust laws are complete, providing enterprises with stable and transparent legal protection.

In addition to doing business, Singapore also has a high quality of life.

The low crime rate, advanced education system, excellent medical services and world-leading food safety standards have created a beautiful environment for people to live and work.

★L(fēng)ow tax paradise

Singapore is renowned for its world-recognized low-tax status.

Singapore’s tax system is extremely simple, with few types of taxes. Individuals do not need to pay asset appreciation tax, capital gains tax or inheritance tax, providing a relaxed environment for wealth creation and inheritance.

For corporate income tax, Singapore only implements a 17% tax rate. Whether it is a local enterprise or a foreign-funded enterprise, income earned in Singapore is taxed in accordance with local principles.

In other words, companies only need to pay taxes to the government when they achieve profits in Singapore.

In recent years, the Singapore government has also introduced tax exemption policies for small businesses with annual operating income of less than S$1 million, which further reduces their burden.

In Singapore, a society ruled by law and a superior life complement each other, and generous social welfare is the icing on the cake. Together, they build a very attractive business paradise, attracting companies and investors from all over the world.

If you are also interested in Singapore or want to invest in a Singapore family office, please contact Xingyunhai International!

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece