This is the best time and the worst time;

This is the age of wisdom and the age of stupidity;

This is the season of light and the season of darkness.

This famous quote by Dickens in "A Tale of Two Cities" seems to apply to every era.

There is a curse over this planet——

Every major move of the Fed is a cycle for emerging countries.

? In the early 1980s: the Federal Reserve raised interest rates and Latin America’s debt crisis After being detonated, Brazil was devastated.

? At the end of the 1980s: the Federal Reserve raised interest rates and Western Europe lost 5 In 2015, Japan lost 15 years.

?The end of the 1990s: Fed hikes interest rates, Asian finance The crisis broke out, Southeast Asia, Hong Kong (region), and Japan collapsed, and the national wealth evaporated overnight, mourning and devastation.

Expansion-peak-burst, this is the fate of the bubble.

It is also the sharpest sickle in the United States.

01  ;

On March 11, local time, US President Biden signed the US$1.9 trillion new crown bailout The bailout bill.

A key question is, where does $1.9 trillion come from?

You know, according to current data, the total federal debt of the United States has approached 28 trillion U.S. dollars, public debt has exceeded 100% of GDP, and the Fed’s balance sheet has exceeded 7.4 trillion U.S. dollars.

The only answer is printing money.

Due to the world currency nature of the U.S. dollar, the over-issued U.S. dollar is not only circulated in the domestic market, but is sent to the world by the United States, that is to say, Inflation has also been sent to the world.

? U.S. dollar returns, bargain hunting and harvesting.

As the former U.S. Treasury Secretary Connery said, "The U.S. dollar is our currency, but it is your trouble."

Not only the United States, but also major economies such as Japan and Europe have increasing liquidity...

The reality is that from March 2020 to now, the amount of money printed in 10 major Western countries other than China has caught up with The sum of money printed in 5000 years of civilization history before 2008.

This directly leads to:

? Commodities are on the rise. The price of crude oil has risen to the highest point since March 2020. . Corn, aluminum, copper, and iron ore all rose.

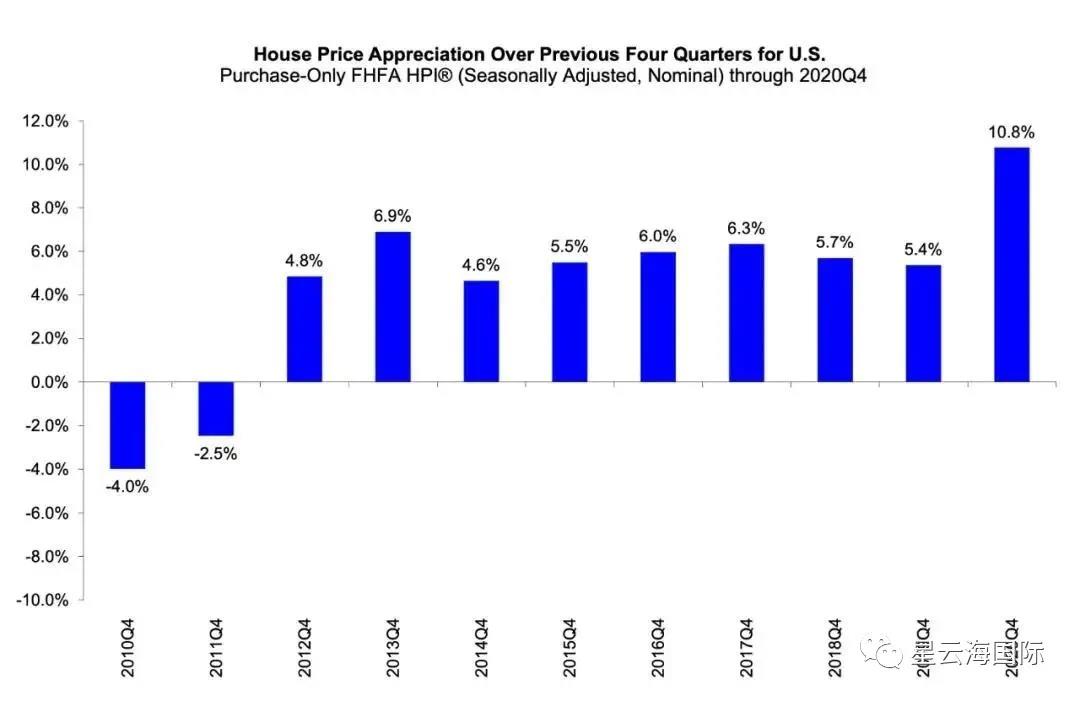

? The property market is rising. The US housing market rose by 10.8% nationwide.

The year-on-year increase in house prices in the fourth quarter of each year since 2010 in the United States

? Bitcoin is the biggest gainer. Bitcoin rose more than 900% in January 2021, reaching $40,000. Now it has penetrated 60,000 US dollars and hit a new high.

A greater global flood may be on the way...

02 span>

"The Father of Global Asset Allocation" Gary P. Brinson said:

"In making investment decisions, the most important thing is to focus on the market and determine the type of investment. In the long run, about 90% of the investment income It all comes from successful asset allocation."

Gary P. Brinson

Asset allocation is effective because different types of assets have different profitability, risk, liquidity, and correlation. Diversified investment can effectively diversify non-systematic risks and avoid high volatility caused by single asset investment.

In the era of global currency release, is it a crisis or an opportunity?

The key is to follow the trend to allocate high-quality assets, avoid shrinking wealth, and do a good job in asset appreciation.

Allocation of assets in core cities around the world is still a relatively safe choice at present.

According to a report released by CoreLogic, an Australian real estate research company, as of the end of February, house prices across Australia have risen by 2.1%, and the median house price has reached $598,884.

Australian house prices have actually set a the fastest rate of increase in 17 years.

Xingyunhai International Australia Melbourne Doncaster Villa

03 span>

Why enter the Australian housing market?

? The official interest rate will remain at a historic low of 0.1%. RBA announced that it will always maintain the cash rate of 0.1%, which attracts a large number of buyers to enter The Australian real estate market.

The RBA board of directors decided to maintain Australia’s official interest rate at historical lows

Source: "Sydney Morning Herald"

? Historical ultra-low mortgage interest rates. For example, Westpac recently announced a major good news, the two-year fixed housing loan interest rate will Downgrade to 1.79%! At the same time, the three-year fixed interest rate will also be reduced to 1.88%!

? Government policy stimulus. The federal government continued to extend the HomeBuilder housing subsidy program for three months in 2021.

And first home ownership subsidies, stamp duty exemptions, house building or purchase incentives, and 5% down payment loan programs and other states The welfare policies have benefited more and more first-time home buyers.

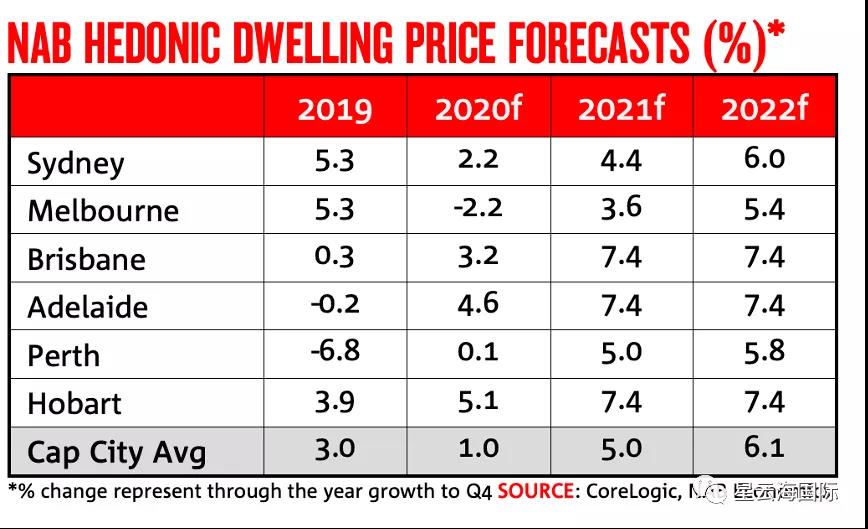

Regarding the future trend of the Australian housing market, the four major banks and major institutions have all made upward expectations< /strong>.

2021 is just a starting point. In 2022, Australian housing prices will usher in a real big increase.

Therefore, investors should follow the good trend and allocate high-quality assets to seize new opportunities for wealth and realize the preservation and appreciation of personal assets.

To learn more about high-quality asset allocation, welcome to contact Xingyunhai International~

source | Australian media, opinions, pictures from the Internet

Australia immigration

High net worth first choice 188C

required

Invest 5 million Australian dollars, of which:

At least 10% invested in start-ups

At least 30% invested in listed emerging companies

The remaining 60% is invested in commercial real estate, corporate bonds or Australian stocks

Advantages

? No age limit, no English requirement (the only investment immigration category in Australia that does not limit age)

? No need to score, no need to start a business

? Low residence requirements in Australia

? Proof of the source of funds is relatively loose (including gift, inheritance and other source methods are acceptable)

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece