In recent years, the tax turmoil of celebrities and anchors has emerged one after another, which not only shows that domestic tax compliance supervision methods are becoming more and more intelligent.

It also indicates that in the future, enterprises or individuals will become transparent under the supervision of the golden tax system.

The picture comes from the Internet | All copyrights are owned by the original author

As a high-net-worth group, facing tax compliance and challenges.

Tax status planning and selection of cost-effective offshore centers are very forward-looking plans.

As one of Asia's most eye-catching offshore financial centers, Singapore is a desirable country. It is suitable for investment and development and is also very livable. It has attracted more and more people in recent years.

A major difference between Singapore and the world's major countries is the principle of territorial taxation, that is, a non-global taxation system.

Intuitively compare the tax systems of Singapore, the United States, Canada and Australia:

Singapore's low tax rate, simple tax system and best business environment are also extremely attractive to investors.

Xiaoxing will take you to understand Singapore’s tax system and understand Singapore’s outstanding tax advantages!

Singapore

Tax system overview

Singapore is a city-state and a unified taxation system is implemented throughout the country. Tax revenue is the main financial source of the Singapore government. The government uses tax revenue to promote the realization of economic and social development goals.

The fundamental purpose of Singapore’s taxation policy is to keep the tax rates for both enterprises and individuals competitive. Maintaining the competitiveness of corporate tax rates will help Singapore continue to attract foreign investment.

Singapore's current main taxes:

? Corporate income tax, personal income tax, goods and service tax, real estate tax, stamp tax, etc.

? Customs duties, gaming taxes, and labor taxes levied on Singapore companies that bring in foreign labor.

? Inheritance tax, which was cancelled on February 15, 2008.

Each of the above taxes is levied and managed in accordance with different laws and regulations, forming Singapore's tax law system.

Singapore

Income tax analysis

Personal Income Tax

The personal income tax of Singapore tax resident natural person is applicable to different tax rate levels according to the level of taxable income, and the taxation scope covers: employment income, property lease, dividend (specified), interest, business income, etc.

Resident individuals defined for tax purposes refer to:

In the year before the tax year, except for temporary departures that are reasonable and not inconsistent with the determination that the individual is a Singapore resident, individuals who have actually lived or worked in Singapore (except for company directors) for 183 days or more.

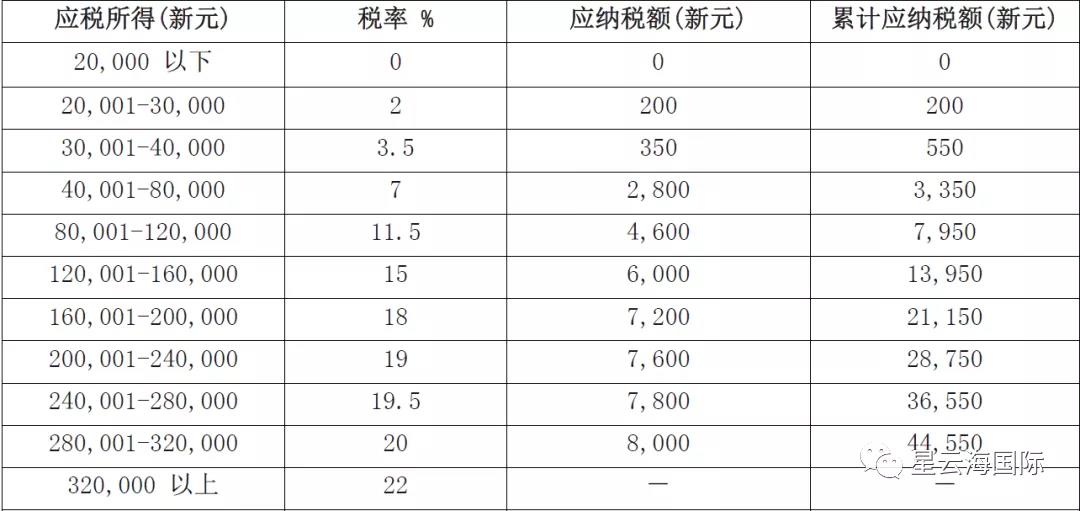

Starting from the 2017 tax year, the applicable tax rate for taxable income below S$20,000 is 0%, and the applicable tax rate for taxable income exceeding S$320,000 is 22%. Starting from the 2018 tax year, the maximum personal income tax relief that an individual can apply for is S$80,000 per year. Individual tax residents in Singapore should pay tax on the difference between their Assessable Income and personal deductions.

The following table shows the personal income tax rate table after the 2020 tax year:

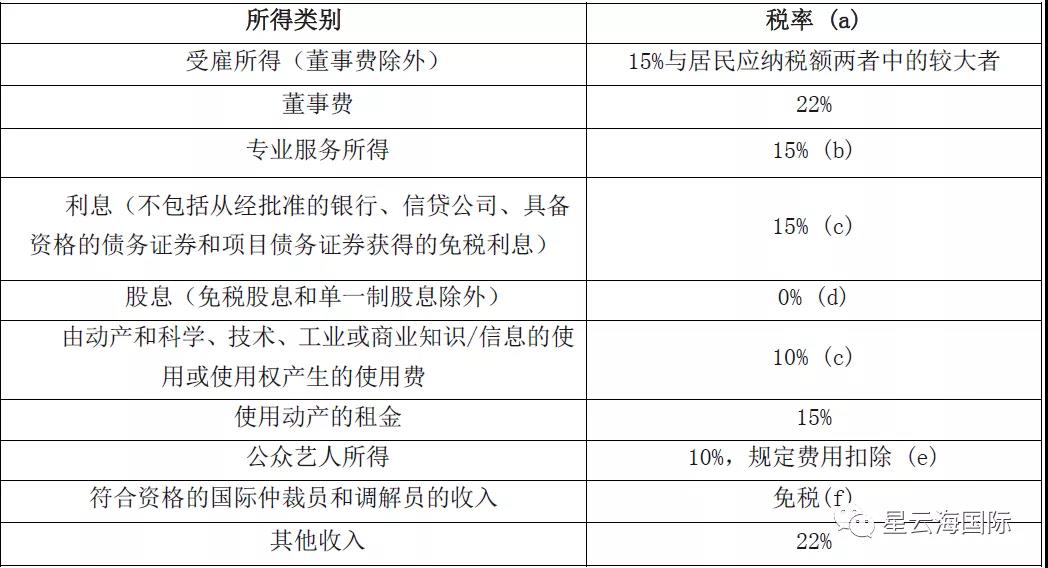

Non-resident individuals should pay tax on their employment income from services provided in Singapore, regardless of whether the remuneration is paid in Singapore or abroad. Non-resident individuals are exempted from personal income tax on foreign source income obtained in Singapore.

Non-resident individuals who are employed in Singapore for no more than 60 days in a calendar year shall be exempted from personal income tax on the part of their employment income derived from Singapore. This tax exemption does not apply to company directors, public entertainers or professionals engaged in professional work.

As of August 15, 2020, the income tax rates applicable to non-resident individuals are shown in the following table:

corporate income tax

According to the Singapore Income Tax Law, if the management and actual control agency of a company is in Singapore, it is deemed to be a resident company in Singapore. Management and actual control agencies refer to the agencies that make decisions on business decisions and strategies.

Under normal circumstances, the location of the board meeting where a company makes strategic decisions is a key factor in determining the location of the management and actual control agency, and then whether the company is a resident company in Singapore.

Companies must pay taxes in Singapore for the following income:

? Income derived from or accrued in Singapore

? Overseas income obtained in Singapore

However, non-resident companies that do not operate in Singapore generally do not need to pay corporate income tax on their income from foreign sources in Singapore.

Since 2010, the applicable tax rate standard for corporate income tax in Singapore is 17%. Among the normal taxable income, the first S$10,000 can enjoy a 75% tax deduction; the portion of S$10,001-200,000 can enjoy a 50% tax deduction. ; The remaining part is subject to corporate income tax at a tax rate of 17%. In addition, during the 2020 tax year, companies can receive a 25% corporate income tax deduction, up to a ceiling of S$15,000.

At the same time, the Singapore government has implemented a series of tax incentives and tax relief policies, including: Pioneer Enterprise and Pioneer Service Company tax incentives, development and expansion incentives (DEI), investment tax exemption, research and development incentives, etc. to encourage enterprises to actively engage in promoting Singapore’s economic and technological development Business activities.

It is worth mentioning that due to the strong support of Singapore’s national policies for economic development, newly established resident companies can enjoy tax deductions for up to three years; while the family office project implements tax exemptions and has inheritable tax exemptions. license.

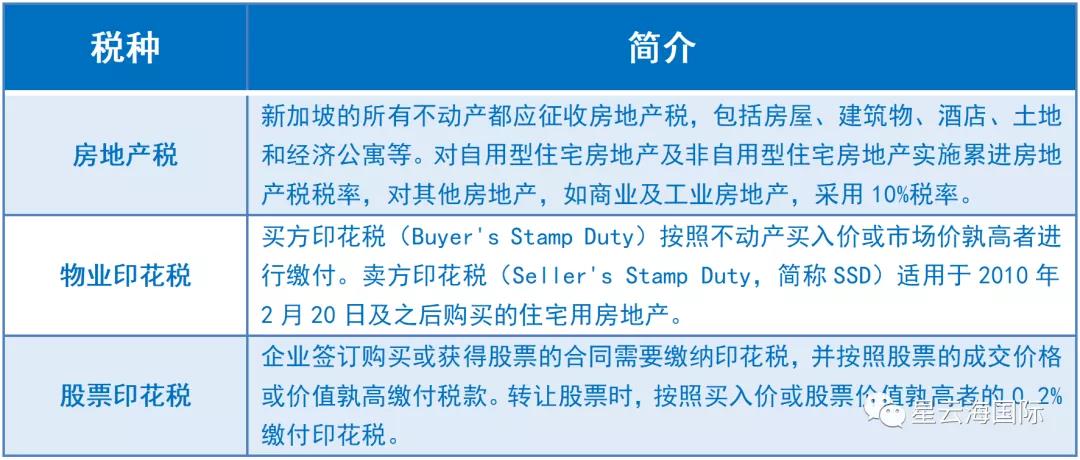

Other taxes

On April 18, 1986, the Chinese government and the Singaporean government signed the Agreement between the Government of the People's Republic of China and the Government of the Republic of Singapore on Avoiding Double Taxation of Income and Preventing Tax Evasion. There are 29 articles in the agreement, and the main part includes five major contents: the scope of application of the agreement, the solution to double taxation, non-discriminatory tax treatment, negotiation procedures, and tax information exchange.

At present, most countries in the world except Singapore have joined the CRS (Common Reporting Standard), that is, the agreement countries/regions inform each other of the financial account information of each other’s citizens in their own countries/regions to avoid tax violations, crimes, etc. .

China has also officially joined the CRS in 2018. It is not groundless that the state of personal assets will be more transparent in the future.

Therefore, for high-net-worth individuals, the importance of tax status planning has become more and more obvious.

Proper tax planning brings maximum protection for the preservation and inheritance of assets. It can be described as the "golden bell and iron cloth shirt" of assets, and it is also the key to the key structure that high-net-worth individuals should first focus on when making asset arrangements.

You are welcome to consult with Xingyunhai International on matters such as asset allocation, identity planning, fiscal and tax planning, and family wealth inheritance.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece