In recent years, policies that benefit Hong Kong people's life and development in the Mainland have been introduced successively, attracting many Hong Kong people to go north to find jobs and start businesses.

Starting from January 1, 2020, Hong Kong, Macao and Taiwan residents who work, live and study in the Mainland can also have a social security card. Like Mainland residents, they can participate in social insurance and enjoy legal rights.

According to data from the Ministry of Human Resources and Social Security of the People's Republic of China, as of now, more than 160,000 Hong Kong and Macao residents have participated in the basic pension insurance plan in the Mainland.

This is the most comprehensive guide for Hong Kong residents to participate in social insurance in the Mainland. Come and learn about it in case you need it! Picture (this article is longer but it's all dry goods, remember to collect and forward~)

These Hong Kong people can participate in Mainland social insurance

According to reports, the scope of Hong Kong people's participation in the Mainland's social insurance includes employees of Mainland enterprises, self-employed persons, and Hong Kong residents who are retirees.

Employment of Hong Kong Residents by Mainland Enterprises

●Should participate in five basic social insurances in accordance with the law, including basic pension insurance for employees, basic medical insurance, work-related injury insurance, unemployment insurance and maternity insurance.

●The employer shall handle the insurance payment registration on its behalf (through the Electronic Taxation Bureau or the Tax Service Office), and the personal payment part shall be withheld and paid by the employer; Hong Kong and Macao residents of self-employed business can hold the business license of the self-employed business and the valid personal certificate Go to the tax service hall of the place of registration.

2. Self-employed Hong Kong people

●You can participate in the basic old-age insurance and medical insurance for employees as required.

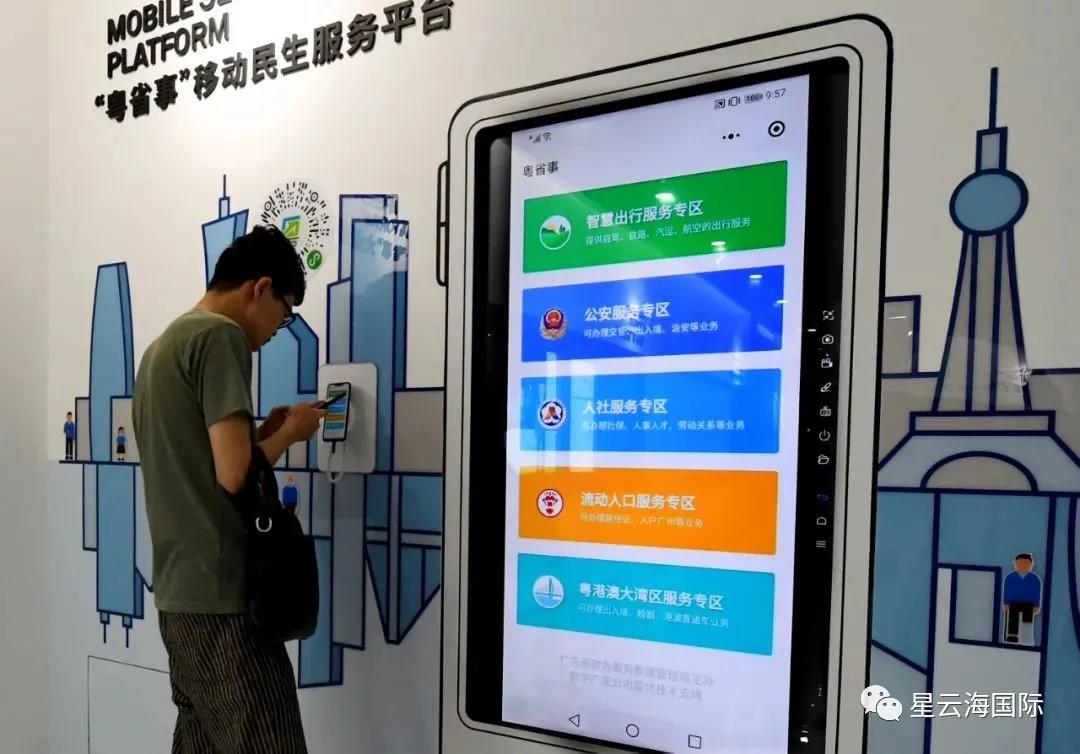

●I have a residence permit for Hong Kong and Macao residents in my place of residence or an employment registration certificate in Guangdong Province to apply for the tax service hall of the employment place in the province, and then pay the social insurance premiums through the "Guangdong Tax Link" or "Guangdong Provincial Affairs" mini program.

3. Retired people or unemployed Hong Kong people

●Can participate in the basic old-age insurance for urban and rural residents and basic medical insurance for urban and rural residents.

●It is also carried out by the person holding the residence permit and bank card of Hong Kong and Macao residents to the social insurance agency, street town (street) office (center, station), cooperative financial institution and overseas entrusted agency, or entrusted residence The local village (residential) coordinator handles it or logs in to the "Guangdong Province Affairs" mini program to handle it. After registration, the social insurance premiums can be paid through the "Guangdong Tax Link" or "Guangdong Provincial Affairs" applet.

2. Hong Kong people participate in social insurance Q&A in the Mainland

Q: Payment policy and standard?

●For employees, pension insurance premiums and unemployment insurance premiums are jointly paid by the unit and the individual. The individual payment amount of the former is 8% of the payment base, the unit payment is 16% of the payment base, and the latter’s individual phased payment rate is not More than 0.5%; work-related injury insurance premiums are paid by the unit and not by the individual.

●Self-employed persons pay pension insurance premiums by themselves, and the contribution rate is 20%.

●For unemployed residents, the individual chooses the payment grade according to the relevant regulations of the place of residence, and the government provides certain subsidies.

Q: What are the conditions for enjoying benefits?

●In terms of endowment insurance, employees must meet the conditions of age and payment at the same time. Men are required to be at least 60 years old, and women must be at least 50 or 55 years old according to different positions, and the cumulative payment must be at least 15 years; urban and rural residents must meet the conditions of 60 years of age and 15 years of cumulative payment at the same time.

●In terms of work-related injury insurance, employers participate in insurance and pay premiums in accordance with the law, and employees are recognized as work-related injuries due to work-related injuries or occupational diseases.

●In terms of unemployment insurance, unemployed persons who have participated in the insurance and paid for more than one year and have not interrupted their employment due to their own will can apply for unemployment insurance benefits.

Q: What kind of treatment standard and calculation method do you enjoy?

●In terms of endowment insurance, it follows the principle of “paying more, earning more for long-term pay”, and consists of basic pension and personal account pension. Monthly basic pension = (based on the average monthly salary of the employees in the province in the previous year when I retire + my indexed average monthly contribution salary) ÷ 2 × payment period × 1%, monthly personal account pension = personal account savings at retirement ÷ country The prescribed number of months.

●In terms of work-related injury insurance, Hong Kong and Macao residents who are recognized as work-related injuries can enjoy work-related injury medical treatment, rehabilitation, and assistive device configuration, as well as disability and work-death benefits.

●In terms of unemployment insurance, the amount standard shall be lower than the local minimum wage standard and higher than the minimum living security standard for urban residents, which shall be stipulated by the governments of various provinces (autonomous regions and municipalities).

Q: What is the handling process?

? Make an appointment online, and choose the nearest social security bureau to handle it.

? Arrive at the Social Security Bureau at the appointment time, and the self-service number picking machine will pick up the number and queue up with the appointment information.

? Window processing, according to the staff's guidance, choose the appropriate insured gear.

?After receiving the acceptance notice, you can receive a short message notification from the Social Security Bureau that you have successfully participated in the insurance on the same day, indicating the deduction date and the recommendation to apply for the XX City Financial Social Security Card.

?Apply for a financial social security card, which is convenient for future medical treatment.

Q: How to apply for a financial social security card?

? Take a 1-inch ID photo with a white background at the local photo studio and obtain a social security photo receipt.

? Bring photo receipts, residence permits for Hong Kong, Macao and Taiwan residents, and home visit permits.

?Choose China, Agriculture, Industry, Construction, China Merchants and other banks to handle it.

?After completing the bank card application, return to the bank to collect the card within one and a half to six months.

Q: Is there a unified service platform?

The Ministry of Human Resources and Social Security officially launched the national social insurance public service platform on September 15, 2019. Currently, 33 unified national social insurance services have been opened in 9 categories. Insured persons from Hong Kong and Macao can use their social security numbers to self-check individual social security rights and interests, handle social security relationship transfers, complete endowment insurance qualification certification, apply for unemployment insurance benefits, perform pension and unemployment calculations, and check the status of social security cards, etc., to achieve " "One Net Work".

picture

Q: How to deal with social security relations when leaving the Mainland?

Hong Kong and Macao residents who leave the Mainland before reaching the required pension requirements, their social insurance personal accounts will be retained, and if they come to the Mainland again to work or live and continue to pay, the cumulative number of years of payment will be calculated.

Q: How to solve the problem of double payment?

Hong Kong and Macau residents who have participated in local social insurance in Hong Kong and Macau and continue to maintain their social insurance relationship may not participate in endowment insurance and unemployment insurance in the Mainland with a certificate issued by the relevant authorized institution.

Q: Inquiry about related matters?

You can call the local human resources and social security telephone consultation service center:

●Guangdong Province: (8620) 12333

●Shenzhen: (86755) 12333

●Guangxi Zhuang Autonomous Region: (86771) 12333

●Yunnan Province: (86871) 12333

●Hainan Province: (86898) 12333

●Fujian Province: (86591) 12333

●Xiamen City: (86592) 12333

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece