Singapore has always been known as one of the most competitive economies in the world. Its low tax policy has also attracted a large influx of investment and talents.

Whether it is an individual or a business, Singapore provides many preferential policies and financial benefits to help you unlock more wealth appreciation opportunities and release your wealth potential!

PART 01

single tax system

Singapore is one of the few countries in the world with a low tax rate and a single tax system. Singapore is taxed on the basis of territoriality, that is, income generated by companies and individuals in Singapore or derived from Singapore, or received in Singapore or deemed to be received in Singapore , are all taxable income in Singapore and need to be taxed in Singapore.

Accordingly, if the income is sourced outside Singapore and is not received or deemed received in Singapore, it is not taxed in Singapore.

PART 02

low corporate tax rate

Singapore implements a unified corporate income tax policy for domestic and foreign-funded enterprises, and the ordinary corporate income tax rate in Singapore is only 17%!

All expenditures or profits invested in Singapore are subject to income tax, unless relief is specifically provided for in the Income Tax Act.

tax exemption plan

●Newly established company

All newly incorporated companies are eligible for the tax exemption scheme, except:

◆Companies whose main business is investment holding;

◆Companies that develop real estate for sale, investment, or both.

The newly incorporated company must also:

◆Incorporated in Singapore;

◆Become a tax resident of Singapore for the tax year;

◆Its total share capital consists of not more than 20 shareholders throughout the base period of the year of assessment;

◆Direct beneficial holding, of which:

All shareholders are individuals;

Or at least one shareholder is an individual who owns at least 10% of the company's outstanding common stock.

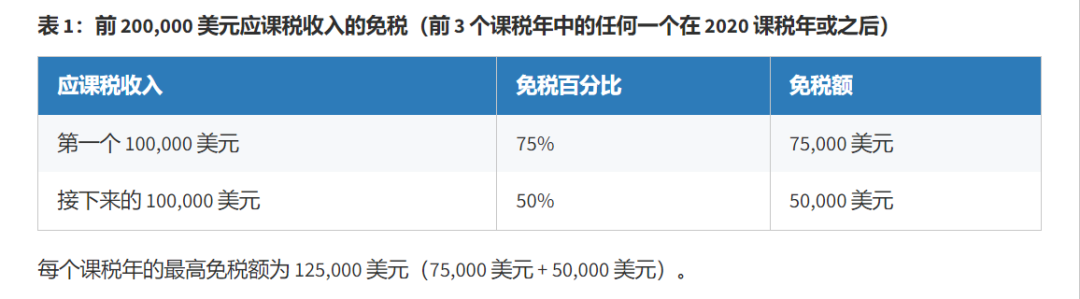

tax exemption plan

tax allowance

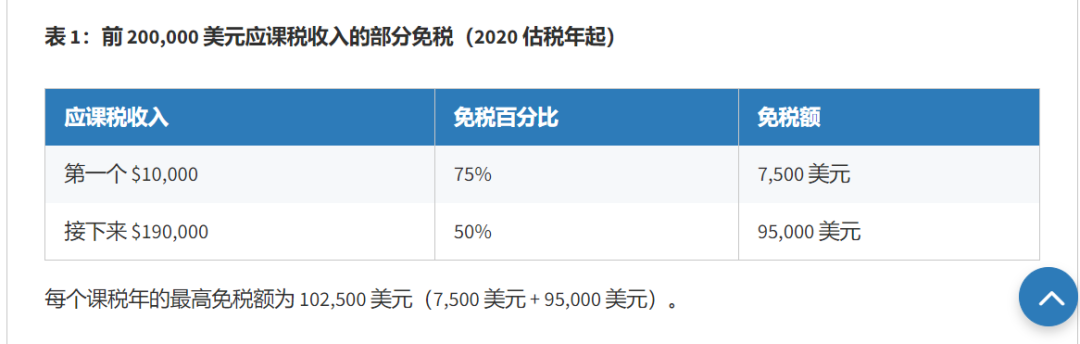

●All Singapore companies

Under Section 43 of the Singapore Income Tax Act 1947, all companies, including companies limited by guarantee, are eligible for Partial Tax Exemption (PTE), unless they apply for tax exemption for newly incorporated companies.

tax exemption plan

tax allowance

PART 03

Low personal income tax rate

Singapore's personal tax is also very attractive, one of the lowest tax rates in the world.

The personal income tax rate of Singapore tax residents adopts a progressive system of 0-22%, and the current highest tax rate is 22%.

From Year of Assessment 2024, the maximum personal income tax rate will increase. Chargeable income over $500,000 to $1 million will be taxed at 23%, while over $1 million will be taxed at 24%.

Although the top personal income tax rate in Singapore has increased from 2024, it is still relatively low.

PART 04

No capital gains tax, inheritance tax

In Singapore, high-net-worth individuals enjoy many benefits, one of the biggest advantages being no capital gains tax and inheritance tax. For high-net-worth individuals, it can manage wealth better and more flexibly, increase wealth, and inherit wealth.

No capital gains tax provides more investment opportunities for high-net-worth individuals, who can invest more freely and obtain a higher rate of return; and no inheritance tax also brings great advantages to high-net-worth individuals, making it easy to transfer their wealth Inherited from generation to generation!

Singapore is not only a country with prosperous economy, but also a region with rich welfare. If you intend to move to Singapore, please contact Xingyunhai International!

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece