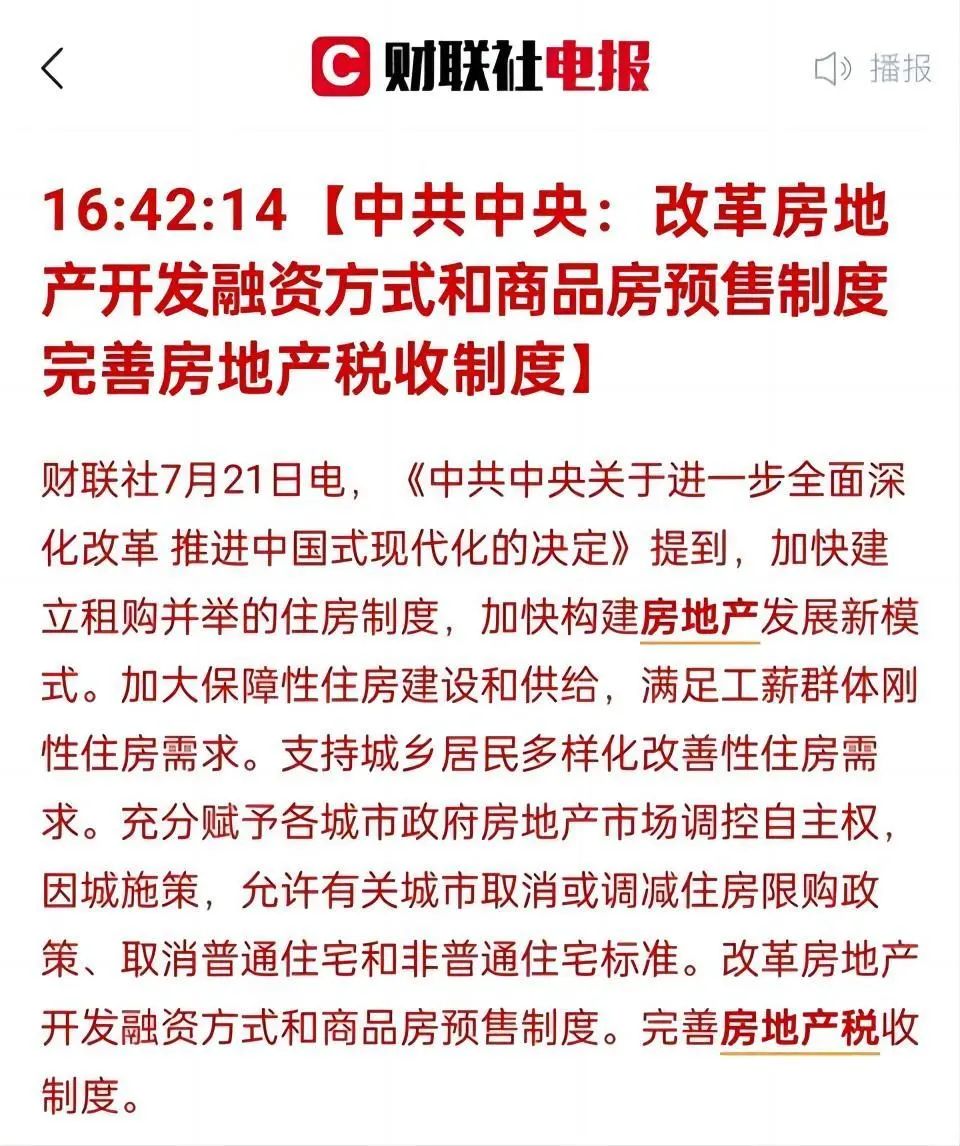

In the "Decision on Further Deepening Reform and Promoting Chinese Modernization" issued on July 21, it is clearly mentioned that the real estate tax system should be improved. There is no doubt that the reform of real estate tax is imminent.

Although the specific tax base setting of real estate tax (such as whether it is fully covered, the first set of exemption policy, the per capita rated exemption area or the tax calculated according to the proportion of the total house price, etc.) has not yet been clarified, it is foreseeable that the holding cost of the domestic real estate market will increase.

This policy orientation has undoubtedly prompted some investors to turn their attention to overseas markets to optimize asset allocation.

Among them, Japan, where the real estate market continues to heat up, is very likely to become a preferred place favored by many investors.

01

Multiple positive factors are superimposed

It is the right time to invest in Japanese real estate

In recent years, the Japanese real estate market has shown a strong growth trend. According to the authoritative release of the Japan Real Estate Economic Research Institute, the average price of newly built houses in the Tokyo area, which is a weathervane of Japanese housing prices, will exceed 80 million yen in 2023, equivalent to about 3.73 million yuan. (July 23, 2024, 1JPY = 0.047CNY)

This not only reflects the strong market demand, but also indicates the broad prospects for investing in Japanese real estate.

Image source: Nikkei Chinese website

At the same time, the global economic fluctuations have led to a sharp drop in the yen exchange rate, the steady recovery of the tourism industry and other multiple positive factors, creating an unprecedented opportunity for investors who intend to enter the Japanese real estate market.

According to survey data, the amount of overseas funds flowing into the Japanese residential market has increased fourfold in the past five years.

In addition, the current financial environment in Japan is loose, and loan interest rates remain at a historical low. For example, the policy interest rate range is stable at 0 to 0.1%, which is far lower than the peak level in the past period (such as 6%).

This provides investors with extremely favorable financing conditions and cost-effectiveness, further enhancing the attractiveness and competitiveness of the Japanese real estate market.

02

Investing in Japanese real estate

Can you get a long-term residence visa?

Japan is not a traditional immigration country, and there is no policy for immigration by purchasing a house.

However, if investors invest 5 million yen to set up a physical company in Japan and invest in real estate projects, and use house rent as operating cash flow, they can meet the eligibility requirements for applying for a Japanese business management visa, thereby achieving long-term residence and enjoying many benefits such as Japan's high-quality medical services and livable living environment.

In addition, children holding business management visas can freely choose to attend national, public or private schools in Japan during the compulsory education stage and enjoy the same high-quality educational resources as local Japanese students.

With a lower investment cost, you can get a considerable return on investment and enjoy a high quality of life. In view of this, Japan has become a favorite destination for many Chinese families to immigrate.

According to the latest statistics released by the Immigration Bureau of Japan, as of the end of 2023, there are 888,339 Chinese living in Japan, accounting for more than a quarter of the total foreign population in Japan.

If you are also interested in investing in Japanese real estate or want to move to Japan, please contact Xingyunhai International, we will provide you with a tailor-made exclusive plan.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece