The much-anticipated Beijing Stock Exchange has finally opened!

On November 15, the Beijing Stock Exchange (hereinafter referred to as the "Beijing Stock Exchange") announced the inauguration, and 81 listed companies collectively sounded the bell to go public. The third stock exchange in China's domestic capital market officially opened.

On the first day, the Beijing Stock Exchange has accumulated more than 2.1 million investors to make an appointment to open the Beijing Stock Exchange's qualified investor rights. Looking back at the grand opening of the market, it can be described as "a red one", with the highest increase of 493%.

Figures | Xinhua News Agency

How will the Beijing Stock Exchange change China's economic logic? As an investor, how to share the dividend? What is a better investment?

The strategic positioning of the Beijing Stock Exchange has been improved

Seize the opportunity of the times in the reform

Since 2012, as the economy "descends" and with the arrival of major changes in the pattern of new and old industries, how to meet the demand for direct financing has become the main line of capital market reform.

The establishment of the “Science and Technology Innovation Board” in June 2019 accelerated the progress of reforms. In October 2019, the New Third Board launched a comprehensive deepening of reforms and introduced selected layers; in August 2020, the GEM launched a pilot registration system, and the establishment was proposed in September 2021. The Beijing Stock Exchange was launched under such an era, and the era of equity in the reform of the capital market is approaching.

In the deepening and continuation of the NEEQ reform, the establishment of the Beijing Stock Exchange has raised its strategic positioning. In the "dislocation competition" with the Shanghai and Shenzhen Stock Exchanges, it may be helpful to resolve the failure of the selection layer reform (weak liquidity) , Lack of attractiveness).

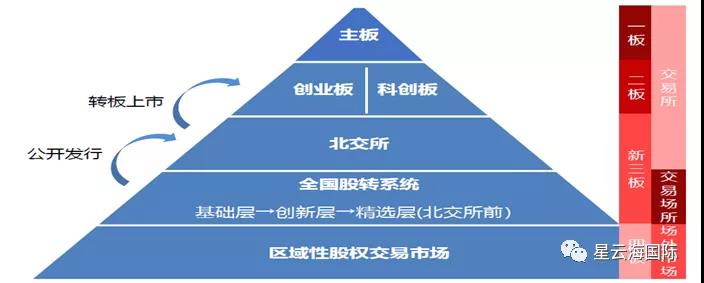

my country's multi-level capital market construction, as of 2021-11

Wherever the hot money flows, there are opportunities. Shanghai has the Shanghai Stock Exchange and the Science and Technology Innovation Board; Shenzhen has the Shenzhen Stock Exchange and the Growth Enterprise Market. The establishment of the Beijing Stock Exchange may be the capital version of the South-to-North Water Diversion.

With Shanghai and Shenzhen exchanges

What are the institutional differences?

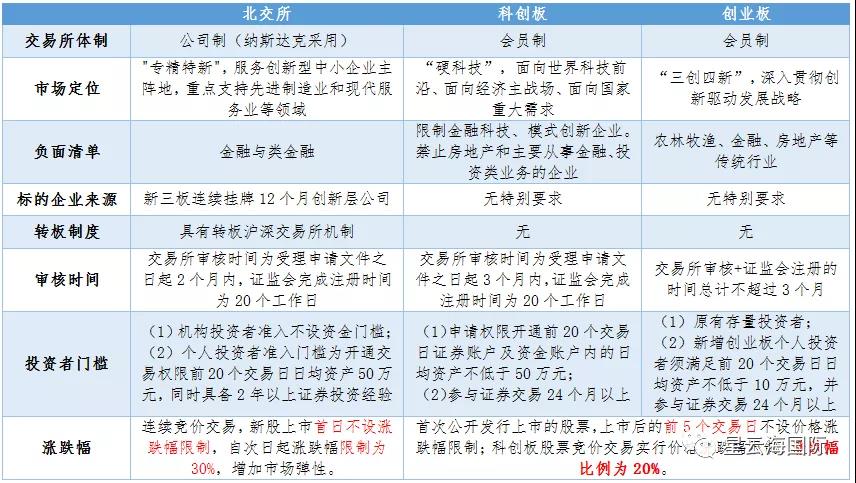

At present, the Beijing Stock Exchange, the Science and Technology Innovation Board, and the Growth Enterprise Market have differentiated "dislocation competition" in terms of system construction and market positioning at different levels. In fact, the Beijing Stock Exchange has basically shifted the selection system from the institutional point of view, and the partial adjustments are mainly due to the demand for the status of the "exchange". For the three major markets, the Beijing Stock Exchange has lower requirements for financial indicators, shorter listing review time, a more relaxed trading system, a transfer mechanism, lower investor thresholds, and a series of innovative advantages in supporting mechanisms that are equal to the science and technology innovation board.

Figures | Xinhua News Agency

Compared with the 1 million yuan threshold for the selected layer, the personal investment threshold for the Beijing Stock Exchange is further reduced to 500,000 yuan. As of the end of 2020, the number of qualified investors on the New Third Board has reached 1,658,200, which is a certain gap compared with the number of qualified investors on the Shanghai and Shenzhen Stock Exchange. The number of individual investors is expected to expand significantly after the threshold of the Beijing Stock Exchange is lowered. (Data source: National Equities Exchanged Corporation)

Data source | Wells Fargo Fund, GF Securities, Shenwan Hongyuan Securities

Where are the opportunities for Beijing Stock Exchange?

How to invest money?

The financial industry, real estate companies, preschool education, subject training, and companies with overcapacity are not allowed to list on the Beijing Stock Exchange. This sends a very important signal-the standard has changed.

In the past, finance, real estate, K12, and the Internet were king. In the future, it will be manufacturing, high-tech, specialization, and specialization. (Enterprises with specialization, refinement, specialization, novelty, and "four modernizations" characteristics)

Figures | CBN

Based on the positioning of the Beijing Stock Exchange, relevant professionals suggest:

1) Focus on innovation, small and medium-sized enterprises and opportunities for "specialization, specialization and innovation"

2) Pay attention to the investment opportunities of high-growth and low-value companies of the Beijing Stock Exchange

What is a better investment?

Compared with investment forms such as stocks, futures, and international exchange rates, the "play" of overseas real estate is relatively simpler, and overseas real estate has some "unique characteristics" that make it more advantageous than domestic real estate investment:

1) Freehold property

2) Lawyers intervene throughout the process to protect the rights of buyers while avoiding risks

3) The rental rate of return is high, generally between 3%-7%

4) Resource distribution, which can play a role in identity planning, children's education, asset allocation, hedging of single currency risks, pure investment and financial management, inheritance, tax planning, etc.

Investors can only realize the long-term compound interest effect by looking at the broader global market for asset allocation. For issues such as global asset allocation and overseas real estate investment, please contact Xingyunhai International for details!

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece