Space technology research and development has become a rising star in Singapore's investment landscape, according to a recent report in the Lianhe Zaobao.

01

Space Technology R&D

A new blue ocean of investment for family offices

The potential and value of space technology R&D as an emerging investment sector is widely recognized globally.

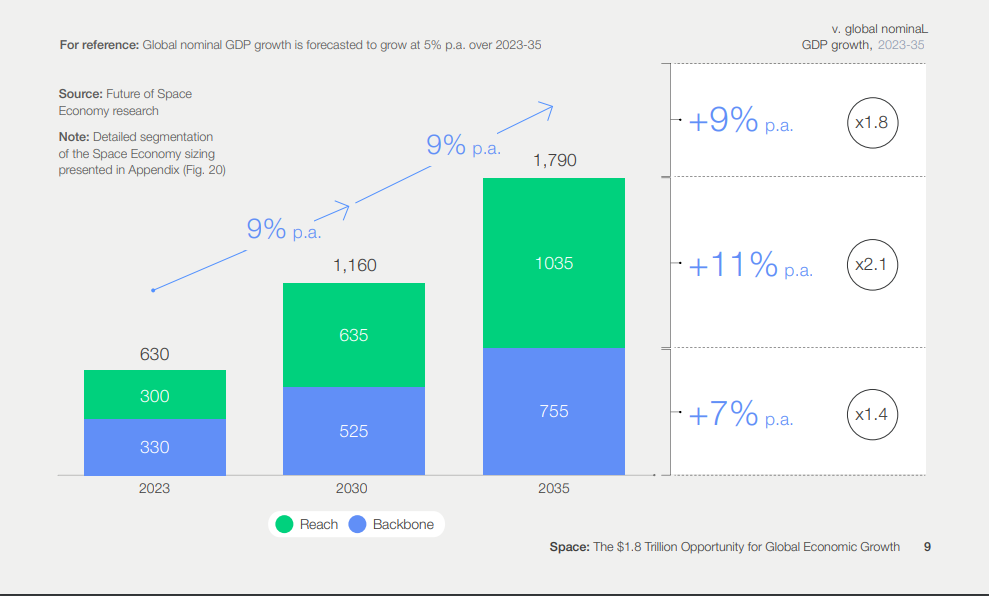

An earlier report released by consulting firm McKinsey & Company and the World Economic Forum showed that the value of the global space economy is expected to grow from $630 billion in 2023 to $1.8 trillion in 2035.

This huge market potential makes space technology research and development a high-profile investment area.

Bogart, the founder of Seraphim Space, has established a family office in Singapore in recent years and has invested in more than 120 space tech companies in total through gas pedals, VCs and under growth funds.

In a recent media interview, Bogart revealed that the family office in Singapore has shown a strong interest in the space investment theme compared to other regional markets.

It is reported that about 15 family offices in Singapore are currently exploring the possibility of investing in space-themed funds, indicating a high level of interest and anticipation in this area.

Space investments cover a wide range of areas, including:

★ Upstream: hardware, software, launchers, space tugs, satellite constellations, high altitude platform stations;

★ Space economy: space services, infrastructure, R&D and manufacturing in space;

★ Downstream: communications, ground terminals, security and warehousing, satellite data.

Source: Seraphim Space

There are two main reasons why family offices are interested in space investments:

One, the returns on space investments are very attractive, for example, Seraphim Space's first space venture capital fund launched in 2016 achieved a triple return in five years;

The second is that Singapore's family offices are highly international investors themselves, and they are looking for new investment opportunities in the space tech sector to discover the next unicorn companies.

02

Singapore.

A latecomer to the space tech space sector

Although Singapore is not a traditional powerhouse in the aerospace industry, its growth in the space tech sector has huge potential.

According to Bogart, Singapore has strong R&D capabilities in science and technology, an excellent higher education system and an adequate innovation budget, which have fostered a range of space technologies and driven its rapid development in the field.

For example, universities such as Nanyang Technological University (NTU) have partnered with a number of aerospace startups and research institutes to develop high-tech products such as remote sensing microsatellites.

According to statistics, more than 1,800 space industry experts are currently employed by more than 50 companies in Singapore.

To further boost development, the Singapore government will invest S$150 million in implementing research and development in the space sector, aiming to incentivize researchers to research and develop space technology solutions that can support important areas such as aerospace, maritime, and sustainable development, as well as exploring emerging and disruptive technologies.

In summary, Singapore has great potential and advantages in space technology. With the growing global space economy and the Singapore government's support for space technology development, it is believed that Singapore will achieve even more remarkable results and breakthroughs in this field.

If you are interested in investing in Singapore, registering a company, opening a family office, or planning to apply for Singaporean identity, welcome to contact Nebula International and we will provide you with customized and exclusive services.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece