important Notice!

On July 5, 2023, the Singapore family office regulations will be revised again! The new rules and regulations will be released on the same day and will take effect immediately!

01

Assets scale up

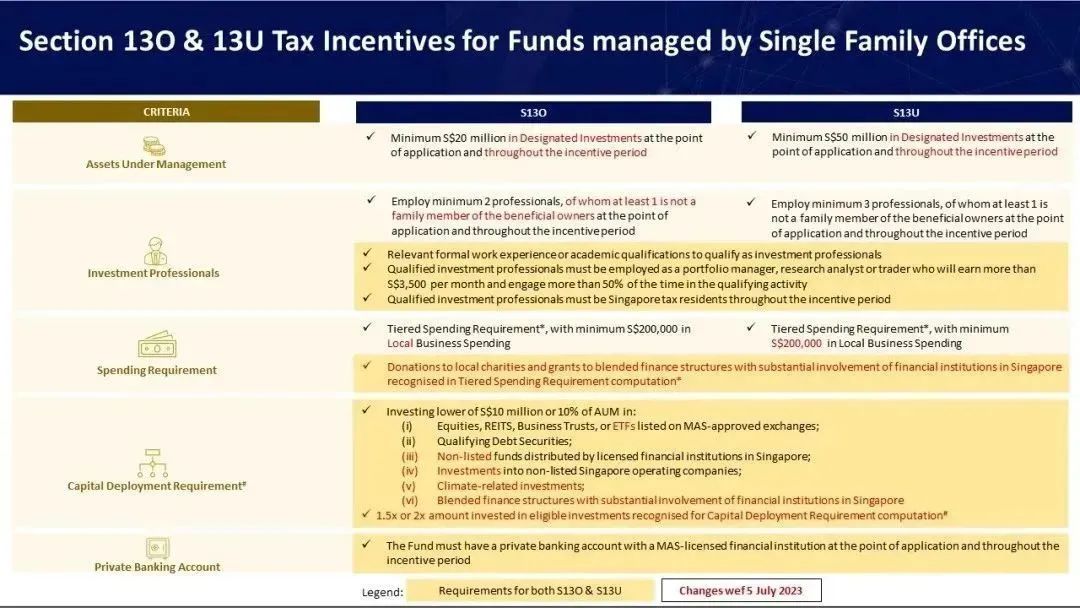

According to the new regulations of the family office in Singapore, before submitting the formal application for "13O", a one-time investment of 20 million Singapore dollars is required, and this amount must be maintained continuously; while the old policy only needs to meet the investment threshold of 10 million Singapore dollars, reaching 20 million within 2 years million Singapore dollars.

This means that the previous buffer period has been cancelled, bringing higher challenges and requirements to investors in Singapore family offices.

example

Under the conditions of July 5, 2023:

1. If the designated investment asset management scale of the "13O" fund is lower than SGD 20 million at any point in time after the start of its "13O" award, the "13O" fund cannot enjoy tax-exempt treatment.

2. If the AUM of a "13O" fund in designated investments subsequently rises to at least S$20 million and remains unchanged throughout the base period, it is exempt (provided the investor also meets other relevant conditions).

02

Professional investor changes

The "13O" old policy of the Singapore family office allows two professional investors to be hired as family members, and both husband and wife can apply for 2 EPs (family office work permits). In addition, the second professional investor also enjoys a one-year grace period.

The latest Singapore family office "13O" policy has changed, requiring at least one of the two professional investors hired to be a non-family member, and both husband and wife can only apply for one EP.

03

Refine the minimum capital investment direction

The latest family office policy has taken an important step in detailing the direction of minimum capital local investment. Among them, climate-related investment and hybrid financing structures have been newly added, providing family offices with more specific and broad investment fields.

It is worth mentioning that the investment that meets the requirements can also be enlarged by 1.5 times or 2 times to further motivate investors to actively participate.

From 10:00 am on July 5, 2023 (including 10:00), all Singapore family office "13O" and "13U" project applications submitted to the Monetary Authority of Singapore (MAS) will be subject to this new regulation.

Regarding the previous "13O" and "13U" projects of Singapore family offices, especially those submitted and approved after April 18, 2022, they can choose to comply with the new tiered expenditure framework and capital deployment requirements, and in July 2023 Filed in the annual return due after 5 days.

If the approved Singapore family office "13O" and "13U" funds fail to meet the specified continuous operation conditions during any tax base period, the fund will not enjoy tax exemption during the relevant tax base period.

However, it does not affect its enjoyment of tax exemption in any subsequent period of the fund's validity period, provided that the fund can meet the specific conditions of the subsequent period.

The threshold for family offices in Singapore continues to increase, but its attractiveness remains unchanged, attracting many high-net-worth individuals to invest in them.

If you are also interested in this and want to know more about it, you are sincerely invited to contact Xingyunhai International!

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece