BREAKING NEWS!

Databricks, a leading U.S.-based data and artificial intelligence company, selects Singapore as the location for its regional headquarters for Asia Pacific and Japan.

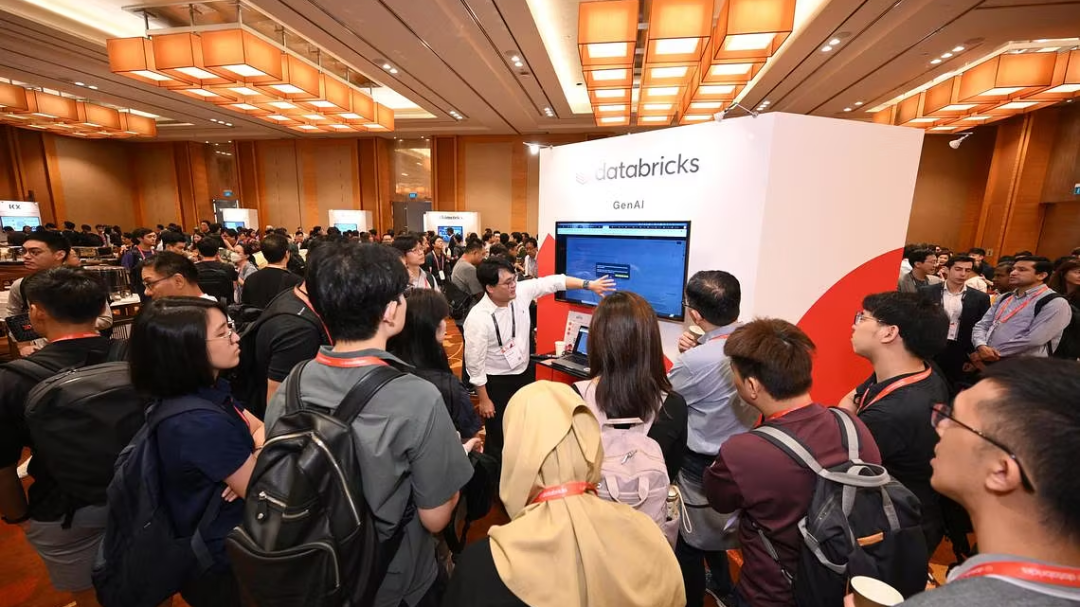

Photo credit: United Daily News

01

Databricks moves into Singapore

It ranks seventh on the global unicorn list

On August 30, Singapore's Minister for Digital Development and Information Technology, Mr. Tan Kit Hoe, officially announced that Databricks will set up its Asia-Pacific regional headquarters in Singapore at the “Data + AI World Tour Singapore” event.

Databricks, a unicorn company specializing in data analytics and artificial intelligence since its inception in 2013, was ranked seventh on the newly released Hurun Global Unicorn List 2024 with a valuation of RMB 305 billion, demonstrating its outstanding position in the industry.

With this establishment of its regional headquarters in Singapore, Databricks plans to train more than 10,000 professionals over the next three years and expand its presence in a number of areas, including sales, marketing, field engineers, strategy, data and artificial intelligence.

It's worth noting that in addition to emerging unicorns like Databricks, Singapore is also home to a number of world-class tech giants and well-known companies.

Renowned companies such as Google, Meta, Amazon, Microsoft, Alibaba, Tencent, etc. have set up regional headquarters or important branches in Singapore.

02

Singapore's favorable business environment

Becoming the first stop for companies going overseas

It's no coincidence that Databricks and other well-known companies chose Singapore, as Singapore has a unique advantage in attracting companies to the region.

Here are some of the key points of Singapore's business advantages:

? Excellent geographic location and transportation network;

? Stable political and rule of law environment;

? Open economic policies and tax incentives;

? Abundant human resources and innovation ecosystem;

? Internationalized business environment;

? Good international reputation and brand image.

In addition, the Singapore government attaches great importance to innovation and talent cultivation, and actively creates an environment conducive to business development through a series of supportive policies, subsidies and tax incentives, such as the Research Incentive Scheme for Enterprises (RISC), the Training Grant for Enterprises (TGC), the Finance and Treasury Center (FTC) concession, and the startup concession.

As far as the tax system is concerned, Singapore has no capital gains tax, dividend tax, inheritance tax, etc. The corporate income tax rate is only 17%, and the personal income tax is implemented in a stepped system, with the highest rate being 24%.

As a result, Singapore has topped the Business Environment Rankings published by the Economist Intelligence Unit (UK) for 16 consecutive years and is expected to maintain its leading position in the next five years.

Meanwhile, in the Global Competitiveness Yearbook 2024 published by the International Institute for Management Development (IIMD) in Lausanne, Switzerland, Singapore was ranked as the world's most competitive economy, surpassing strong rivals such as Switzerland and Denmark.

If you are considering incorporating a company in Singapore and would like to know more about the incorporation process, government subsidies and other related information, please contact Nebula Hai International and we will provide you with customized and exclusive services.

Cyprus

Cyprus Turkey

Turkey Saint Kitts and Nevis

Saint Kitts and Nevis Greece

Greece